“Fortunately, prospects for the U.S. economy appear solid.”

Fed Chair Janet Yellen (9/24/15)

Heading into the fourth quarter, there are growing concerns for the health of the global economy and the possibility that it may threaten the six plus year U.S. economic expansion and stock market advance. The S&P 500 Index, for example, has just endured its worst quarter in four years. Our view, however, is one of cautious optimism:

- We agree with the Federal Reserve’s forecast for continuing improvement in the U.S. economy.

- We recognize that the U.S. stock market could remain volatile in the near-term, yet anticipate an extension of the bull market in U.S. stocks through 2016.

- The UK, Euro area, and Japan are expected to enjoy accelerating GDP growth next year and their equity markets are attractively valued.

- China’s and India’s shifts to more modernized economies represent areas of strength and may contain investment opportunities with secular tailwinds within otherwise challenged emerging markets.

We recognize that the recent stock market turmoil reflects heightened risks to global financial markets, which we are carefully monitoring; further economic disappointments may require us to modify our views. At this point, however, one should not lose sight of the many positive factors that continue to support the global economy.

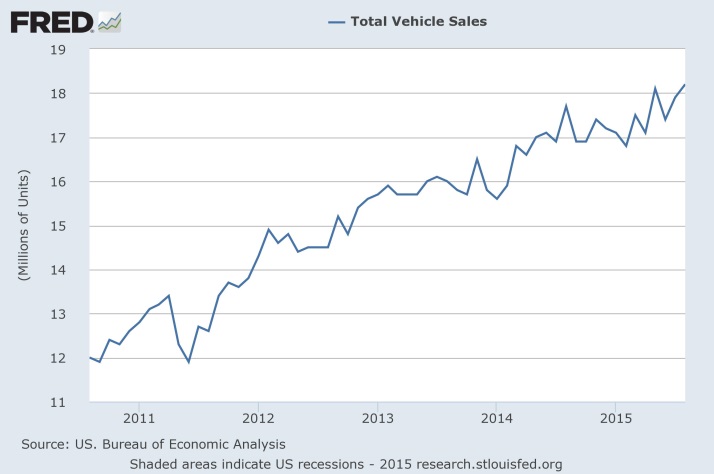

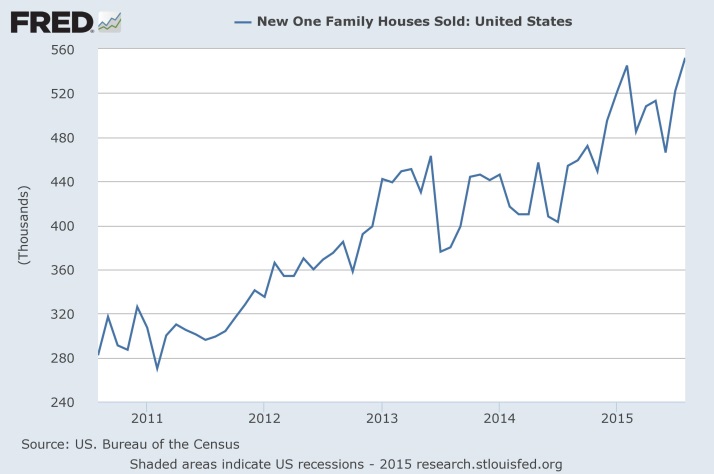

U.S. consumers, who represent about 70% of the economy, are supporting modest growth in domestic production. They are benefiting from reduced unemployment, falling energy prices, and rising real wages. Strong consumer confidence is evidenced by monthly car sales that reached a ten year high in September and a buoyant housing market.

Nevertheless, there are pockets of weakness in the U.S. economy. The energy sector is challenged by the collapse in oil and natural gas prices. U.S. exporters and manufacturers are threatened with soft international demand and the strong dollar. In sum, we forecast real GDP to rise from approximately 2.3% this year to 2.7% next year.

Our investment policy is to look beyond current conditions, which often are transitory, and to focus on the upcoming 6-12 month period. We have identified six fundamentals that historically have supported U.S. stock markets and that have been present since the beginning of the current bull market. We are optimistic that each of the following conditions will remain positive and will continue to support equity markets:

- A growing and preferably accelerating economy

- Healthy corporate earnings prospects in most economic sectors

- Low and stable inflation and interest rates

- An accommodative Federal Reserve

- An attractively, or at least fairly, valued market

- Relatively unappealing money market fund and bond alternatives

We recommend that investors favor growth companies that will continue to prosper in the current slow growth economic environment. In particular, consumer discretionary, consumer staples, select technology, and healthcare should perform well. We are currently less enthusiastic about commodity, energy, and multinational companies confronting a rising dollar and weaker international markets. We will continue to track key leading indicators that would warrant investment in these challenged sectors.

Developed country economies and markets on balance are promising. Economic prospects for Euro Area countries are looking up. The Greek Crisis has faded and the European Central Bank continues to implement accommodative policies. Similarly, Great Britain’s economy is solid and the Japanese policy makers have the political capital necessary to initiate additional stimulus measures to promote growth. All of these countries are benefiting from currency weakness relative to the dollar, as newly attractive exports are seeing stronger demand. Further, valuations for these developed equity markets are attractive. On the other hand, countries which are heavily dependent on commodity exports, such as Canada and Australia, are expected to continue to experience challenging conditions.

There is also a mixed outlook for emerging economies. On the positive side, India most likely will enjoy the strongest GDP growth of the world’s major economies and our forecast calls for over 7% growth in 2016. Slowing growth in China has worried investors and was a trigger for recent downward pressure on global equity markets. We recently addressed this problem in more detail (see our August 24 blog “A China Correction”), concluding that while manufacturing and export related industries will continue to contract, the Chinese consumer remains a source of strength and is becoming a major driver of the global economy. Similar to Canada and Australia, many of the emerging market countries are reliant on commodity exports which have plunged in price. We do not foresee a lasting recovery that supports investments in these countries. However, some companies in emerging markets have significant prospects for growth, especially those that benefit from the long-term economic developments in China and India.

The bond market continues to provide low yields and trade near all-time high prices. Treasury yields fell across the board last quarter as investors sought a safe haven amidst equity market turmoil. The demand for high-quality bonds remains strong. Junk bond yields have risen from multi-year lows due to concerns about the oil sector’s ability to pay its debts, but the yields are at best close to their long-term average. We do not recommend that investors take undue risk in this area. The Federal Reserve remains poised to raise rates sometime in the next six months and we expect this to slightly elevate bond yields, but strong demand for high grade fixed income will likely keep the benchmark 10-year Treasury yield under 3%.