We continue to hold to our January 6th forecast that a synchronized global economic expansion in 2021 will support another year of rising stock markets. The International Monetary Fund recently (04.06.2021) projected 2021 global GDP growth of 6.0% led by the US (+6.4%) and China (+8.4%). Similarly, JPMorgan expects U.S. GDP growth of 6.4%. Both forecasts revised upward their growth targets from earlier in the year. We are more optimistic; U.S. GDP growth will be at least 7% if the pace of reopening continues. This acknowledges that the economic path forward for most countries, including the U.S., will be determined by their ability to secure and distribute COVID-19 vaccines, sustainably reopen their economies, and successfully implement effective fiscal and monetary policies. In 2020 there were investor fears of a severe and prolonged virus-related recession, global GDP shrank by -3.3%, and every major economy except for China suffered negative growth. Now, all major regions are expected to grow at above average rates, COVID-19 cases are well off their peaks (though concerningly rising in some parts), and staggering amounts of financial relief is breathing life to the economy. We are closely watching the progress to overcome the pandemic as well as any signs that recovery efforts trigger excessive inflation, but we believe we are in the early stages of a new bull market. At this time, we recommend investors take a disciplined approach and stay with their long-term strategy.

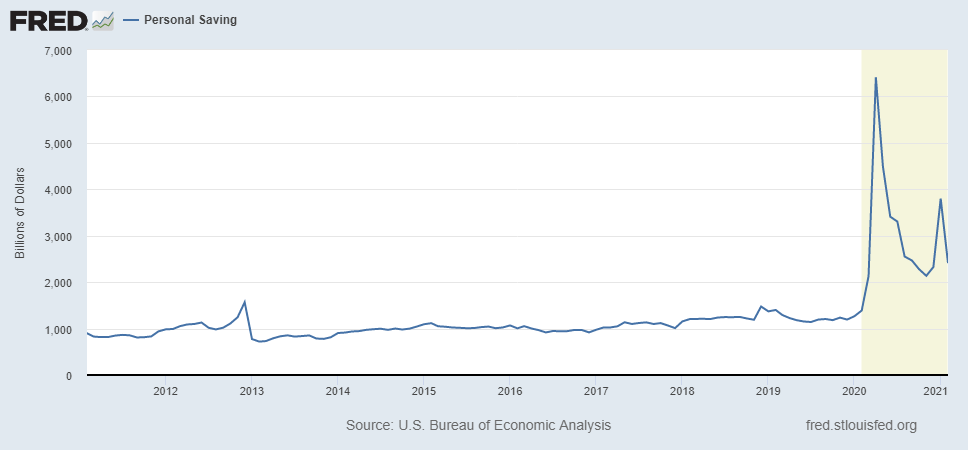

The US economy will enjoy a strong rebound this year as the COVID-19 threat subsides and economic restrictions lift, with monetary and fiscal stimulus providing additional support. The COVID-19 situation has clearly improved: over 3 million vaccine doses are administered on average each day, over 25% of the US adult population has now received two doses, and hospitalization rates continue to decline. As a result, states and cities have further eased emergency restrictions. As the entire country has begun its long-awaited “reopening,” the labor market has drastically improved. The unemployment rate has come down to 6.2% from a high of nearly 15.0% and the US added over 900,000 jobs in March. Besides benefiting from reopening, US households have been supported by monetary and fiscal policies. The $1.9 trillion stimulus passed in March and the Federal Reserve’s commitment to keep interest rates low have put the US economy on steadier footing. While many people have not felt the recovery yet, consumer confidence is on the rise and average household savings rates are at elevated levels (see chart).

The US is further along in its vaccination efforts than most, but as other countries undergo a similar process and reopen with increased immunity in the coming quarters, the US economy will further benefit from the virtues of a broad-based, synchronized global economic expansion. This optimistic outlook assumes that vaccines stay effective against the prevalent COVID-19 strains and new coronavirus variants do not spread to an extent that lockdowns are brought back.

At the other end of the spectrum, we must be watchful that the stimulus and easy monetary policy does not lead to an overheated economy with excessive inflation. At this juncture we do not think inflation will be a drag on the economy. We have already seen reports of short-term higher prices, but we think this is due to businesses trying to catch up to growing demand with pandemic-idled production capacity. The March Producer Price Index (PPI) showed 1.0% month over month price increases, the second highest on record. These are extraordinary numbers but we expect that once producers can increase hiring and production capacity, the inflation pressures will subside. Over the past decade, the greater threat has been disinflation rather than inflation and we should not lose sight of the fact that it is healthy for inflation to run at or slightly above the Federal Reserve’s 2.0% inflation target.

The fundamental backdrop is positive for US stock markets. The Federal Reserve has promised to continue accommodative policy and a faster-than-expected recovery should enable companies to report stronger earnings and give better guidance. FactSet estimates full-year corporate earnings will surge over 23% year-over-year, which we consider conservative. This large increase in profits will moderate what currently appear to be lofty P/E multiples. Moreover, alternative investments to equities, such as bonds and money market funds, provide low and unattractive potential returns, further justifying elevated stock market valuations. Coming off a deep but short-lived recession, the market is experiencing a period of transition. Historically stock market recoveries from recession have resulted in a change in leadership. Whereas growth and momentum stocks, led by information technology industries, are favored leading up to recession, value and economically sensitive stocks found mostly in the financial, consumer discretion, and energy/commodity sectors come to the forefront during recoveries. This has been the case since the positive vaccine news broke on November 6, 2020 with the Russell 1000 Value Index surging 23.1% while the Russell 1000 Growth Index improved a more modest 6.0%. Similarly, stocks of businesses that were depressed or even shut down during the pandemic have been catching up to the companies that were minimally affected over the past year. The worst stocks of 2020 performed the best in the 1st quarter of 2021. It is possible that this trend will continue near term, but we prefer companies that can demonstrate earnings and revenue growth from pre-pandemic levels. Certainly, investors should hold some investments with improving prospects due to the reopening (travel/leisure, entertainment, manufacturing), but we continue to emphasize companies with strong fundamental attractiveness that benefit from trends that will run long past the point of full recovery.

The pace of recovery across regions is striking. Nevertheless, IMF forecasts that every major economy will recover from recession this year and continue growing in 2022. We think this will create numerous and significant investment opportunities across countries and industries. The Eurozone should bounce back to 4.5% growth in the second half and the UK will see full year output at 5.0-6.0%. In the near-term we favor developed economies as they will likely recover more quickly. These regions also have value-oriented sectors like financials and industrials. China and India are bright spots in the emerging world and are expected to grow at 8.4% and 12.5% this year and moderate in 2022. Mexico will likely experience above trend growth as well given its close relationship to the US.

There are always threats to an optimistic outlook and we closely monitor risks that could disrupt economic growth. Again, first and foremost, is the continued presence of COVID-19 which has begun to rise again in Europe, South America, and India. We are also cognizant of global supply chain shortages, particularly in semiconductors. Further, we think rising nationalism is a significant risk as people in various countries push for less globalization and it could negatively affect international trade. Lastly, as always, we want to keep watch on geopolitical tensions, especially with respect to China.

Across the world, but especially in the U.S., interest rates have turned higher in anticipation of stimulus-fueled spending and economic growth. While the move has been sudden, the 10-Year US Treasury yield jumped from 0.92% to 1.74% during the last quarter, rates are still exceedingly low. The 10-year rate is still lower than 2019 levels and near the lows for the entire 2009-2020 expansion. Rates will likely move higher as this expansion matures but bond investors should not expect a return to a pre-financial crisis yields. This may provide an opportunity to select some bonds at better prices for fixed-income portfolios but we still recommend underweighting this asset class.

One year ago, we wrote at the outset of the pandemic that one key question was “When will there be a return to near-normal activity, and will the mass amounts of unemployed workers be able to resume their jobs?” One year later we can finally see the light at the end of the tunnel as the reopening gets underway. Economic indicators are turning decidedly positive and global stock markets have advanced in anticipation. This process will take place over the next few quarters and it will not be a steady journey, but there are better days ahead.

As always, stay safe and healthy and be optimistic for the future.

The Marietta Investment Team