We expect the global economy to continue its rebound from the COVID-19 Recession of 2020, fueled by reopening economies, unprecedented fiscal and monetary stimulus, and pent-up demand. However, recent developments have tempered the heady optimism from the first half of the year. The Delta variant’s rapid spread, worldwide supply chain disruptions, a sudden rise in inflation, a deteriorating Chinese economy, and the possibility of a US debt default and government shutdown have eroded confidence in the recovery’s duration and strength. Investor sentiment turned pessimistic in response to these developments; for the month of September, the S&P 500 Index slumped -4.8% and the international benchmark MSCI ACWI-ex US Index gave back -3.7%. Despite the recent pullback, looking forward we think that the positives still outweigh the negatives. The most probable outcome is that the global and US economic expansion will continue through 2022, though at a less robust pace than previously forecasted. Fundamentals supporting higher equity returns remain intact and investors should stay disciplined and focused on their long-term strategy.

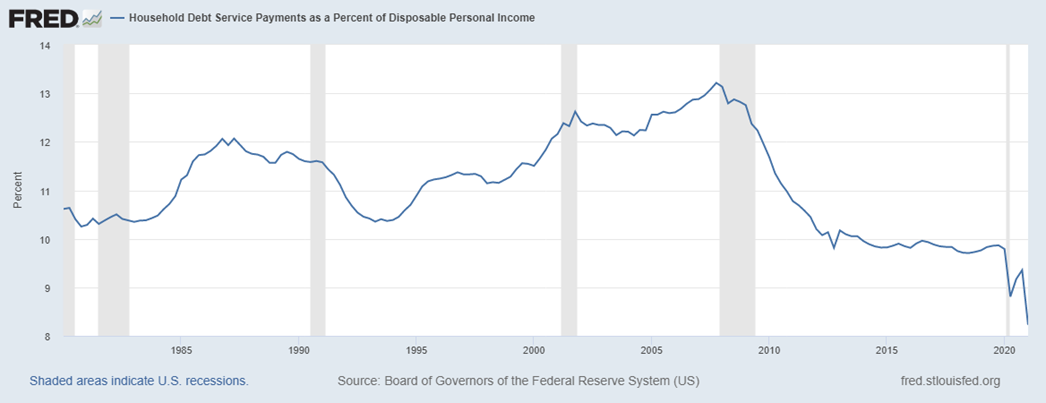

When we wrote our last Outlook in early July, the Delta variant had yet to significantly affect the US. Since then, Delta has brought upon another wave of the pandemic, infecting millions and causing tens of thousands of deaths. The human cost has been profound. Although the virus surge caused immense human tragedy, the economic impact in the US has been relatively limited in contrast with other countries. Despite escalating COVID-19 cases and hospitalizations, restrictive shutdowns were limited, and consumption stayed high. Bolstered by stimulus measures, household savings and balance sheets improved to record highs and debt servicing payments as a percent of income reached record lows.

Consumption remains about 70% of the US economy, and consumers are the wealthiest they have been in decades. With the economy reopening, competition for labor has been fierce, resulting in huge employment gains, job openings, and rising wages. The likelihood of a recession is remote. However, inflation, supply chain and labor shortages, political uncertainty, and Federal Reserve policy have combined to limit growth. We anticipate progress on these issues in the fourth quarter and that they will not be as large of a drag in 2022:

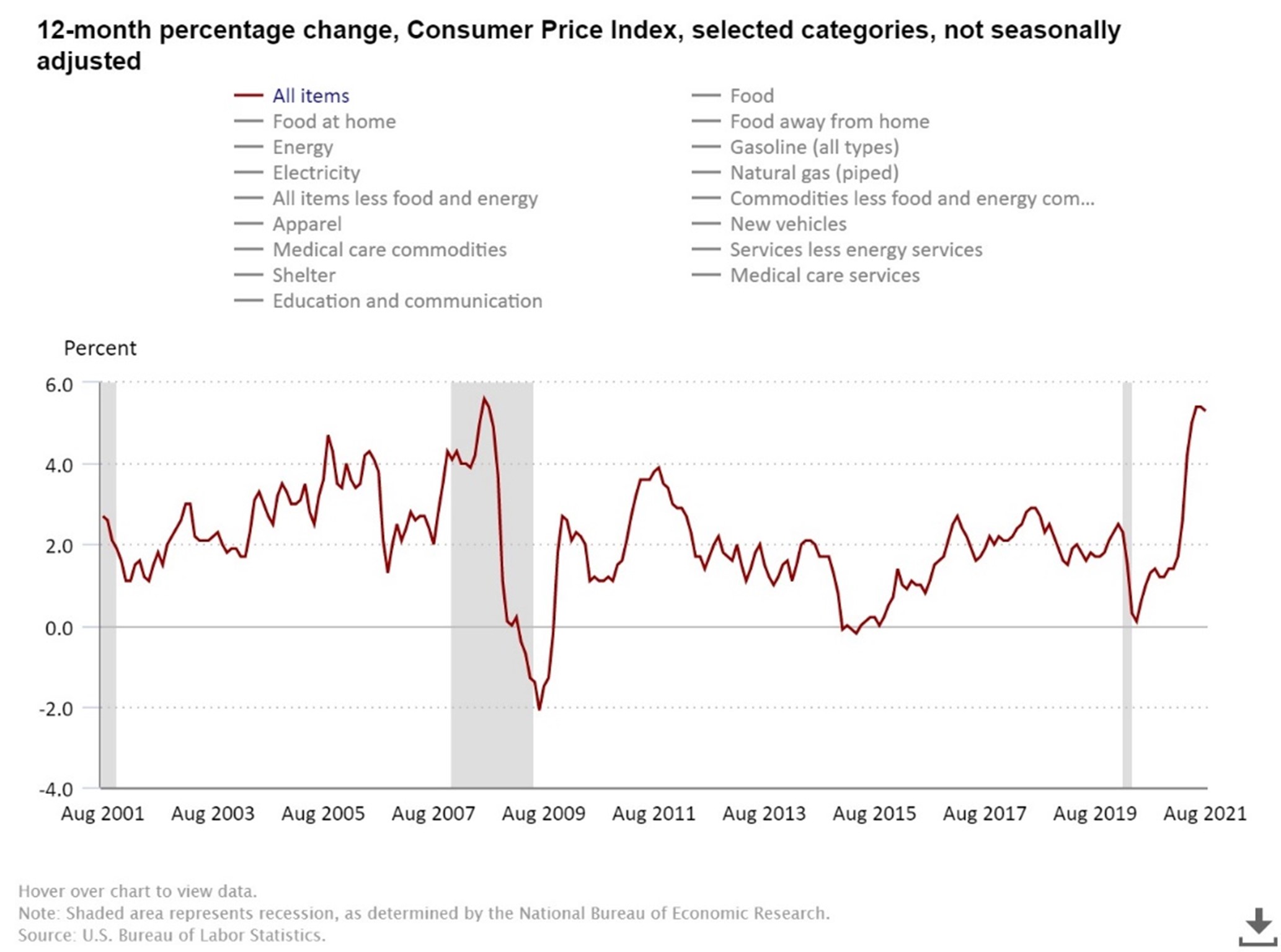

- Inflation: We are in the middle innings of an above-target inflationary period, beginning in the spring. It appears that the initial pent up demand surge is waning, but inflation remains high and tends to go up faster than it comes down. The inflation rate will decline, but prices are not likely to retreat to prior levels.

Commodities like copper and wood have returned to more normal levels following a large spike, and demand for certain big-ticket items, like automobiles, have pulled back from peaks. Higher inflation than the 2008-2019 period may persist, but if this moderating trend continues the specter of excessive inflation will recede. Nevertheless, we acknowledge that the near-term impact is troublesome. The September University of Michigan Surveys of Consumers Report stated the problem concisely:

“Even if transient, higher inflation has already decreased living standards, and further damage is anticipated as just 18% of all households anticipated income gains would be larger than the expected inflation rate.”

- Supply chain and labor shortages: The global supply chain has not been able to adjust adequately to the surge in demand. It has not been uncommon to see empty shelves in stores or to experience month-long waits for household durables, like refrigerators. Semiconductors and shipping containers are a notorious headache. Supply chain issues and labor shortages are being cited more often in corporate earnings reports as a factor negatively impacting margins and profits. If production can ramp up and deliveries can accelerate, then the economy can grow higher for longer. The global supply chain is not static; it will adapt. The question is how quickly it can overcome major bottlenecks.

- Political uncertainty: The situation here is simple, though the stakes are high. If the US defaults on its debt, which would be without precedent, the consequence would be perilous. Fortunately, congress can avoid this ominous fate by simply raising the debt ceiling. Until there is an apparent path toward addressing this serious matter, this risk will remain at the forefront. A government shutdown is an additional potential hurdle, but the consequences are less dire than a default. We think that cool heads will prevail, a budget will pass, and essential government services will remain operative. As in the past, it may take a last-minute, highly contentious compromise, and our expectation is that these obstacles will be cleared before the end of the year.

- Federal Reserve policy: There is speculation that the Federal Reserve will commence a tapering policy (a reduction in its $120 billion per month bond purchases), which will result in a stock market setback. We expect the Fed will taper late in the fourth quarter, but we think it will be gradual, widely anticipated, and not upset the stock market. There is also speculation that runaway inflation will force the Fed to prematurely hike short-term interest rates, but we think the Fed will stick to its timetable of late 2022 or 2023.

The uneven nature of the recovery is likely to continue, but the powerful trend of economic expansion remains the strongest argument in favor of higher stock markets. While US equities have recently pulled back from highs, the 2021 calendar year has thus far produced solid returns. We expect the bull market to continue before year-end, buttressed by strong corporate profits, pro-growth monetary and fiscal policies, and large cash positions on the sidelines. As in the recent past, the primary investment alternatives to stocks, in particular money markets and bonds, remain unappealing.

The most notable feature within international economies is the wide gulf between developed and emerging countries in their ability to combat the virus, recover from last year’s downturn, and provide positive equity market returns. In stark contrast with their emerging market counterparts, wealthy countries benefited from mature healthcare infrastructure, purchased and administered vaccines effectively, and provided fiscal stimulus directly to their citizens. This difference is reflected in the year-to-date 6.9% return of the developed markets ETF iShares MSCI EAFE compared to –2.5% in the emerging market ETF iShares MSCI EEM. Emerging market economies have endured additional stress from a softening Chinese economy, which has been weakened by a fresh round of anti-business policies from its government. Our view is that the prosperity gap between emerging and developed economies will persist for several quarters. Europe, Australia, and Japan have high vaccination rates and are reopening their economies; they will quickly catch up to where the US is now in the recovery process. It is worth noting, however, that this will unleash pent-up demand, which could put further strain on global supply chain issues. Emerging economies and stock markets will struggle until they make substantial improvement in their ability to handle the virus.

As in past outlooks, we continue to recommend the best approach to international equity investing is to focus on the ability of individual companies to thrive despite current economic realities. For example, some commodities companies will benefit from rising global inflation and some semiconductor companies will profit from huge demand. Investments in China, in the past so beneficial, now have higher risk and should be considered only with considerable caution despite strong earnings potential. Also attractive are European companies strongly positioned to profit from the reopening trade as virus concerns recede.

Rising concern for inflation is putting upward pressure on bond yields despite the Federal Reserve’s policy of maintaining a low interest rate environment. For example, the yield on the benchmark 10-year US Treasury has risen from a low of 1.17% as of Aug 4, to a current 1.58%. The yield may well rise further (and the price decline) in the short term as the general economy continues to improve and the Federal Reserve begins to unwind its bond purchasing policy. We thereby recommend that investors emphasize short-maturity bonds despite their relatively unattractive yields.