Can We Anticipate More Good News?

Global investor focus is on the US economy and stock markets, which enjoyed a very strong gain in the first quarter. Can we anticipate more good news? Building on the Marietta Investment Team’s January 19 Outlook, we reaffirm its major points: there are two positive developments which suggest a further, sustainable market advance. First, inflation continues its slow decline, which will permit the Federal Reserve to introduce interest rate cuts this summer. Second, healthy economic growth, based on robust consumer spending, will continue for the duration of the year and fuel strong corporate earnings. Short-term, a market correction, limited in duration and severity, is possible and perhaps overdue, but long-term these two powerful stimulants point to further gains in the stock market and possibly a multi-year bull market.

US Economic Resilience Despite Inflation Above Target

The trajectory of inflation, which peaked at 9.1% in July 2022, has moderated to its current level of 3.2% (Bureau of Labor Statistics), representing a significant departure from the inflationary spikes experienced during the COVID period. Although inflation measures remain above the target, the Fed is evidently content with the progress made and forecasts three interest rate cuts this year. At the March 20 press conference, Fed Chair Jay Powell noted, “inflation has come way down, and that gives us the ability to approach this question carefully and feel more confident that inflation is moving down sustainably.” (AP News) This development is poised to support equity valuations as investors cheer lower interest rates.

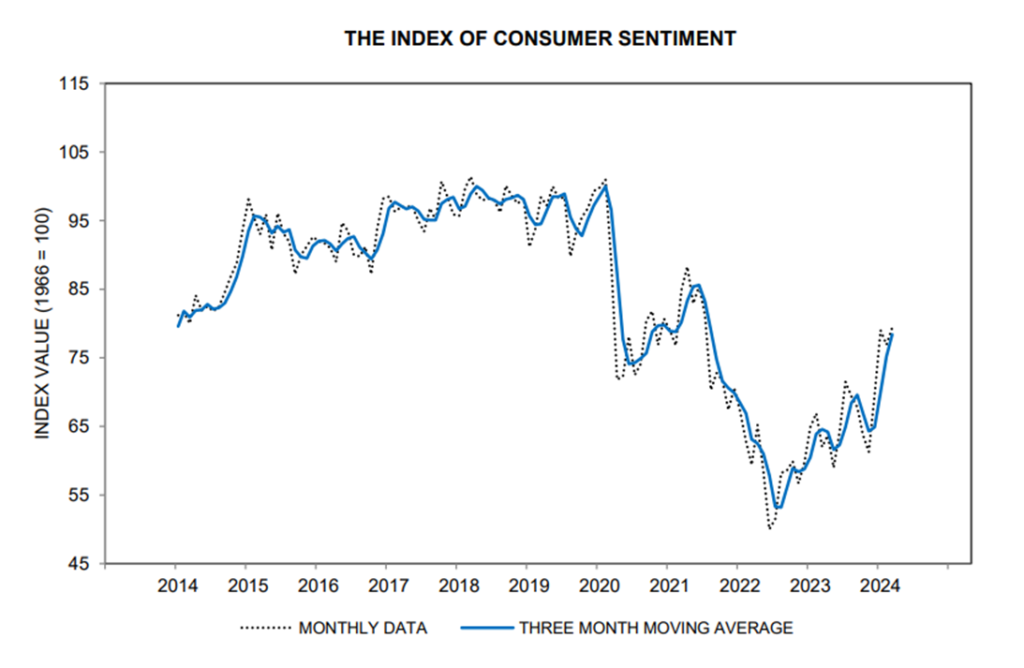

At the heart of ongoing US economic stability is consumer spending, which constitutes nearly 70% of GDP. Despite challenges from elevated inflation and interest rates, consumer spending has remained robust, contributing to fourth quarter GDP growth of 3.4% and a 2.5% growth rate for 2023. The Atlanta Fed’s current estimate for the first quarter suggests a continuation of this trend, with a projected growth rate of 2.8%. Sentiment, while still below pre-COVID highs, has improved. The University of Michigan Survey of Consumers final March results indicate a +3.3% change month over month and a significant +28.1% surge year over year.

This enduring consumer strength, underscored by real wage growth and low unemployment rates, establishes a solid foundation for sustained future spending. Consumer debt is rising but is offset by real wage growth and is not yet alarming. Despite the hurdles posed by higher borrowing costs, this backdrop paints a cautiously optimistic picture for the US economy. A further decline in interest rates, prompted by potential future Fed rate cuts, would reinforce this positive trend.

US Equities: Balancing Growth and Valuation

US equity markets took off in the first quarter in response to declining inflation, robust economic growth, and ascending corporate earnings. With these underlying fundamentals expected to remain steady, the momentum of the current stock rally looks sustainable, with S&P 500 earnings expected to rise 11.0% in 2024 (FactSet Earnings Insight). We maintain our forecast that we are in the early stages of a new, multi-year bull market. Market internals, however, reveal a more nuanced environment for equities. The rally has notably been led by high growth sectors such as Artificial Intelligence, resulting in a concentrated market driven by a handful of companies. This phenomenon has been exacerbated by the ongoing disparity in performance between mega-cap stocks and smaller-cap companies. While market concentration is not inherently problematic, a broader rally across more industry sectors would be indicative of a more robust investment climate. Somewhat more concerning, valuations have risen to a cautionary level, though this could be justified if corporate earnings materialize as anticipated. Elevated valuations pose the risk of sharp negative market responses to adverse news. Considering that, on average, there is a 10%+ downturn every 14 months, a correction in the near future would not be surprising. If this does occur, we would anticipate it to be brief, mild, and perhaps even constructive for market health. While our outlook remains optimistic in the long term, we note that equity gains in the next six months will likely moderate after a notably strong first quarter.

International Recovery

Our forecast for the global economy is gradually improving and we now project a GDP advance of 3.2% in 2024 and 3.4% in 2025. The catalyst for our modest optimism is above-expectation growth in the US and China, supported by another year of healthy growth from India. Apart from the US, GDP gains in most developed countries will be sluggish and remain well below pre-pandemic levels. In particular, the Euro Area, which is recovering from a shallow recession in 2023, will need ECB interest rate cuts and a pickup in US and China trade to achieve 1.0% growth. A potential bright spot is Japan, where policymakers are promising corporate governance reforms, yet it is still difficult to anticipate a GDP growth rate above 1.0% in 2024.

We are keeping a close eye on China and emerging economies, where equity markets have been underperforming for years. The Conference Board estimates emerging and developing countries as a group to grow at a 4.0-4.5% rate in 2024. They emphasize that 70% of global GDP growth from 2025-2030 will be attributable to emerging economies, and they will “remain the key global growth engine.” China policymakers in March established a 5.0% GDP growth target for 2024, which will be a challenge unless the policymakers implement major stimulus. If China exceeds this target, emerging market equities will become increasingly attractive.

In past outlooks we have recommended investments in individual international-based equities rather than increasing international exposure through country ETFs. We confirm this view, as there are compelling international stocks with strong management teams, healthy balance sheets, and solid growth prospects trading at attractive valuations.

Bond Market Stabilization

The Fed is maintaining its 2.0% core inflation target, which we think may be achieved by the end of the year. In this event, short-term rates would fall substantially but we do not expect a similar decline in longer-term rates. For example, we think the benchmark 10-year US Treasury Note will stabilize around 4.0%, or about 2.0% above the inflation rate. It is likely that financial markets will celebrate the re-emergence of a normal yield curve (where short-term rates are below long-term rates) and a Fed policy that is considered neither stimulative nor restrictive. The major risk to our forecast is that stronger than anticipated inflation and growth will trigger a delay in rate cuts.