Cautious Optimism

Our outlook for the US economy and stock market remains constructive, albeit tempered by rising oil prices and long-term treasury yields surging to levels not seen since 2006. Another potential threat is that Federal Reserve policy will be too restrictive by maintaining high interest rates for too long. Despite these headwinds, our 2024 forecast is for US GDP to grow 2.0%, core PCE inflation to soften to 2.0%, and stock market indices to increase in tandem with a projected 10-12% expansion in corporate profits. It is more difficult to hold a positive outlook for the major international economies and markets, with China struggling to control a property crisis and Europe facing stagflation. Yet there are select companies with robust earnings growth which remain appealing. In the bond market, short-term interest rates offer appealing yield and stability, but long-term interest rates carry the risk of moving higher and lowering the value of longer maturity bonds.

Third Quarter Blues

At the writing of our last Outlook on July 14, we expressed an expectation for an economic soft landing in the US. This included slowing growth but avoiding recession due to low unemployment, further easing of inflationary pressures, and a resilient consumer. In August and September, data indicated the economy might actually be accelerating. Retail sales were strong, the unemployment rate remained near its five-decade low, job openings were plentiful, the Manufacturing Purchasing Manager’s Index rose to a ten-month high, and the construction industry was surprisingly healthy. Forecasters rushed to increase GDP expectations. The Atlanta Fed’s GDPNow reading for the third quarter, for example, jumped to 5.1%. Suddenly, the fear that the economy was slumping and headed for a recession was replaced by a fear that the too-hot economy would trigger long lasting inflation. The Fed fueled this view by hiking the benchmark interest rate by 25 basis points and suggesting that rates would remain at elevated levels well into 2024. Long-term bond yields swiftly adjusted higher, which if sustained could burden entities depending on revolving debt. In short, the prospect rose that the Fed would push the economy into recession by keeping rates too high for too long. In September, this dismal mood was exacerbated by the 30% jump in oil prices, labor strikes stoking fears of a wage-price spiral, a potential government shutdown, and further evidence that the Chinese economy had not improved.

A Solid Foundation

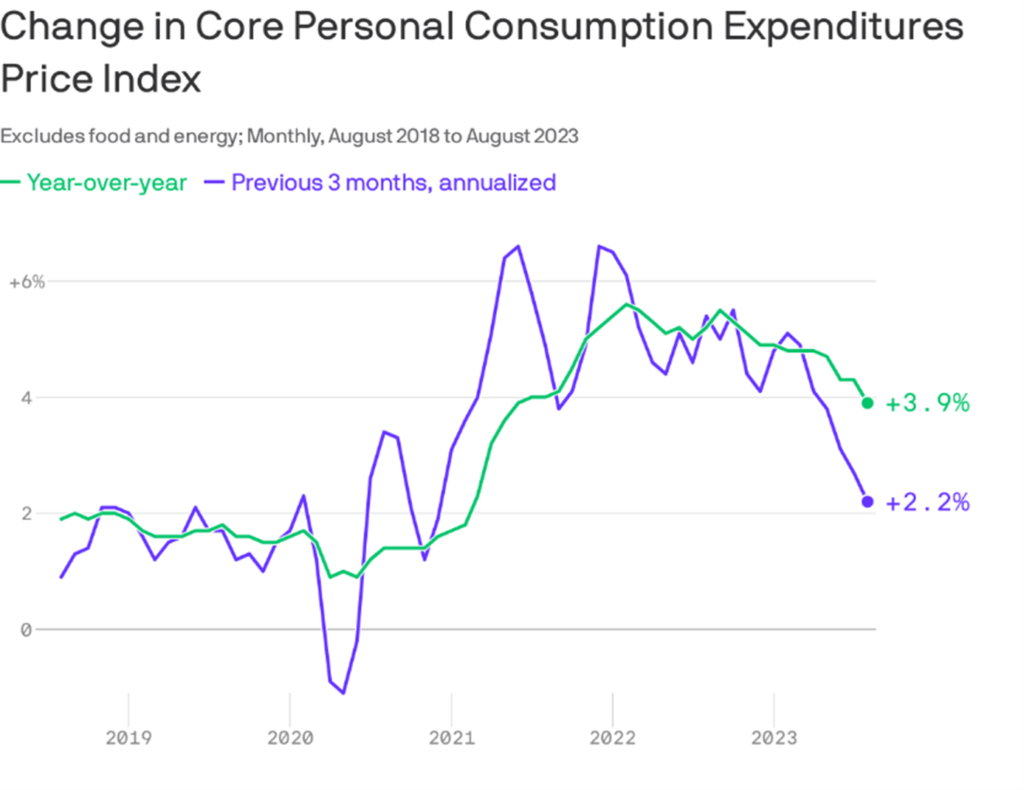

The two pillars of a positive forecast for 2024, which we think will gradually overcome the negative scenarios, are a constructive view of inflation and a continuing expectation of moderate economic growth. The reality is that the Fed’s preferred measure of inflation has been coming down steadily for over a year with a drop from 6.3% to 3.9%: the latest three-month annualized rate shows a near-target 2.2%.

Data: Bureau of Economic Analysis; Chart: Axios Visuals

Easing inflation makes sense considering its main causes. The surge since 2020 was a direct consequence of COVID-19 and the government’s response with unprecedented transfer payments and shutdowns. In contrast, today COVID-19 no longer has a significant economic impact and the stimulus spending has come to an end. We think it is highly likely that inflation will decline to pre-COVID levels by 2025. The case for moderate GDP growth next year is supported by this year’s impressive economy in the face of a Fed Funds rate rising to 5.5%. High borrowing costs will be a drag on the economy but not sufficient to result in a downturn. Among other positives, the labor market and consumer spending may well be slowed but not reversed.

Will Stocks Recover or Retreat?

If our forecasts on inflation and the economy prove accurate, it is likely that we are on the brink of a new bull market. With inflation subsiding in the fourth quarter, we anticipate at most one more quarter-point rate hike from the Fed later this year, followed by a prolonged pause. Less threatening inflation and Fed policy will provide a huge relief to equity markets. Also key will be a return to corporate earnings growth. After three consecutive quarters of contraction, S&P 500 profits are set to accelerate to a double-digit gain in 2024. A claim often used to support the negative forecast is that the market has risen to an unsustainable level and that valuations are excessive. We noted in our last Outlook that the performance of the S&P 500 Index was not representative of the overall stock market. This situation continued through the third quarter, with the S&P 500 +13.1% year to date, whereas the Dow Jones Industrial Average and the Russell 2000 reported modest gains of +1.1% and +2.5% respectively. The S&P Small Cap 600 Index was +0.8%. From this perspective, valuations are not currently excessive. The S&P 500 trades at 17.9x forward earnings, below the five-year average (FactSet Earnings Insight, 9/29/23). We conclude that many quality stocks have attractive valuations, and they will respond favorably to good earnings reports. We prefer companies with strong earnings prospects, especially those that thrive on improving economic conditions in the industrial, technology, and consumer discretion sectors.

International Obstacles

In its latest World Economic Outlook (10/10/23), the International Monetary Fund forecast global growth of 3.0% in 2023 and 2.9% in 2024, well below the 3.8% average over the 2000-2019 period. Numerous economic and geopolitical factors account for this discouraging outlook, but the principal factors are the continuing slump in China and the wide-reaching impact of EU and US central bank policies to reduce inflation. The IMF expects Chinese growth to rebound modestly to 5.0% next year from a below-target 3.0% in 2023 but anticipates a slower recovery in Europe, with the euro area narrowly avoiding recession this year followed by a modest 1.2% gain in 2024. Slightly less pessimistic is the IMF’s expectation of a future decline in global inflation from a high of 8.7% in 2022 to 6.9% in 2023 to a still lofty 5.8% in 2024. We accept the somewhat gloomy prognostications of the IMF but are hopeful that there will be an upside surprise if the policymakers in China and Europe are more successful.

Entering 2023, China’s economy was expected to rebound strongly following the restrictive “zero-COVID” shutdowns. Consumer spending flourished for a brief period, but then deteriorated into weak growth and deflation. During the summer, the policymakers responded with surprisingly weak and ineffective measures. The once prosperous property market is perhaps the greatest problem, but there is also a sharp downturn in exports and industrial production. Chinese consumers have evidently lost confidence: retail sales are slumping, employment is uncertain, and wages are stagnant. In the past, such as in 2008, the Chinese government responded quickly and decisively with successful stimulus policies. Why are policymakers so inactive this time? In a lengthy cover article, “Xi’s Failing Model: Why He Won’t Fix China’s Economy,” The Economist (8/26/23) rendered a verdict that, “Mr. Xi lacks the credibility or focus of previous leaders.” Our view is that the Chinese authorities have the ability to restore prosperity as in past crises, but we do not know whether they have the determination.

The euro area’s economic woes are more similar to the US than China. Inflation is a central problem, which is higher and descending more slowly than in the US. The ECB is determined to stamp out inflation with restrictive measures, but they run the serious risk of pushing the economy into a recession, convincing some observers that they would prefer a hard landing with economic pain rather than failing to reduce inflation. At this point, unemployment remains at a record low while the demand for goods and services is weak. The worst may well be behind us and baked into current forecasts, but there is little evidence of any imminent improvement. Investors should focus on companies that have been able to grow earnings and revenue in the current challenging environment, as we do not have good visibility on when the current headwinds will abate.

Relief for Bond Investors

The major surprise in the third quarter was long-term interest rates rising to decade highs, with the 10-year Treasury yield moving above 4.5%. This has increased the attractiveness of bonds as an investment. We expect long- and short-term rates to remain near these levels throughout 2024. However, we continue to favor bonds maturing within five years as longer bonds still carry excessive interest rate risk. We also recommend maintaining investments in high quality issues rather than junk bonds and view equity markets as a more appropriate asset to seek higher returns in a balanced portfolio.