COVID-19 Operations Update

As the country responds to the COVID-19 outbreak, Marietta would like reassure our clients and partners that we remain fully operational.

Out of an abundance of caution, however, we have asked all employees to work remotely effective immediately and until further notice. For circumstances such as these, Marietta has established and tested procedures that enable us to operate outside the office both securely and at full capacity. We do not expect service interruptions at this time but will continue to share updates as the situation evolves.

If you have any questions, please do not hesitate to reach out.

We hope you and your loved ones are safe in this unprecedented time.

Economic And Financial Market Outlook 2016 Q1

As the New Year has gotten off to a dramatic start, we anticipate 2016 to be similar to last year as fundamental conditions remain largely unchanged. Our most probable scenario for 2016 is substandard global GDP growth, modest advances for most key stock markets, very low returns for bonds and money market funds, and a continuation of challenging conditions for commodities, including oil. We have noted, however, significant divergences of professional opinion, including sharply negative views, regarding the prospects of the world’s major economic and financial markets. The focus will be on U.S. Federal Reserve policy, the dollar, the ability of Chinese policy makers to bolster their economy, commodity prices, and the plight of developing countries. A surprising negative development in any of these factors could slow U.S. economic and profit growth, but we think a full blown recession and bear market is unlikely. Success in equity investing in 2016 will continue to depend on identifying companies able to sustain attractive growth in a difficult macroeconomic environment and resisting the temptation to bottom-fish troubled markets and industry sectors.

We project global GDP growth for 2016 to be about 2.9%, which is slightly above our estimate of 2.7% in 2015. The major advanced economies should expand modestly: we project 2.5% GDP growth in the U.S. with a possible upside surprise, a slight improvement in the Euro area and Japan to 1-2% in response to accommodative central bank policies, stabilized economic conditions in China around 6%, further strengthening in India to 7.5%, and continued recessions in the commodity-exporting emerging countries.

The U.S. economy could surprise on the upside. On the positive side, further employment gains, low energy prices, and a persistent housing recovery will boost consumer confidence and spending. The recent budget agreement in Washington will add a measure of fiscal stimulus. Further, many of the structural impediments to growth arising from 2008-2009 will continue to erode.

We expect the S&P 500 Index to rise 7-10% in 2016. We view the U.S. market to be fully but not overvalued and expect the S&P 500 Index to rise in-line with corporate profit growth, which we project will be 7-9%. That is, we think the correlation between market performance and profit growth in 2015 will extend to 2016. Stock prices will continue to be buttressed by unattractive prospects for bonds and money market funds and continued high levels of M&A activity and stock buybacks.

The U.S. market will likely experience increased volatility in response to news regarding key market influences. We advise investors to maintain a longer-term perspective and not be overly influenced by short-term developments.

- We expect the Federal Reserve to gradually raise rates to 1.00 – 1.25% by year end, which we do not think will create economic distress or prolonged market turmoil. Possible threats are a resurgence of inflation that might prompt the Federal Reserve to adopt a more aggressive rate hike policy or, conversely, indications that the economy is too fragile to weather even this modest set of rate increases.

- Contrary to consensus opinion, we think the dollar will stabilize against a basket of currencies at the current level. The dollar rose 25% from mid-2014 to March 2015 but has since traded in a narrow range. We expect a relatively stable dollar through 2016 based on the determination of the IMF and the Federal Reserve to avoid the negatives resulting from an upward spiral. A sharp rise in the dollar would damage the currencies, economies, and markets of commodity exporting countries, and inflict more pain on the U.S. energy industry, reduce the profits of U.S. corporate exporters, and jeopardize our 7-9% corporate profit forecast.

- A widespread negative view is that the Chinese economy is in free-fall leading to a hard landing and clumsy attempts by policymakers to manage the slowdown will be ineffectual. The investors that maintain this view fear that China will export recession to other countries, which in turn will possibly foment a U.S. recession. The global stock market slide over the first four trading sessions of 2016 was dominated by events in China that seemed to justify the pessimism. We maintain our positive view expressed in past outlooks and blogs that the Chinese economy is successfully undergoing a transition from exports and investment to consumption, and we forecast 2016 GDP growth at about 6.0%. The policy makers, including the People’s Bank of China, clearly are determined to avoid a further slide in growth, and we believe they have the tools to prop up the economy if necessary.

- We think that the five-year decline in commodity prices will extend through 2016. A significant rise in the price of oil is unlikely as long as Saudi Arabia and OPEC keep the spigots open and Iran comes back online, with U.S. producers poised to increase production as soon as wells become profitable. On the other hand, some investors fear that if commodity prices fell sharply lower, it would portend a slowdown in global demand. They believe that the economic benefit from cheaper costs to consumers and businesses would be more than offset by job cuts and lower investment from resources sector.

Despite challenging economic headwinds confronting many international economies, we think there are pockets of opportunity and companies of considerable potential which are attractive to investors.

- The leading advanced international economies of Euro area and Japan should build on their 2015 equity market progress. Although widely accepted benchmarks for international stocks were negative in 2015, there were local currency stock market gains of 8.2% in Japan, 10.8% in Germany, 10.0% in France, and double-digit advances in many other European countries. We anticipate a combination of economic pickup and further accommodative stimulus by the Bank of Japan and the European Central Bank to provide a promising outlook for 2016.

- Demographic trends and the growing middle-class in Asia provide significant opportunities for equity investors. Many of the economies of this area are troubled by the slowdown in China and decline in commodity prices, but the rise of middle-classes supporting consumption goes on, especially in China and India. Multinational corporations providing goods and services to this middle-class can maintain attractive revenue and profit growth despite macro headwinds.

- Equity investing in the heavily damaged markets of the commodity-exporting emerging countries offers more risk than reward, at least for the first half of the year. Although most equity markets and company stocks in this category suffered in 2015 and their valuations seem attractive, we prefer to see a significant improvement in conditions to justify investments.

The three-decade long decline in bonds yields is probably over. The prospect of a U.S. economic surprise on the upside, the probability of an uptick in inflation, and the advent of the Fed rate hiking process should result in a modest rise in bond yields. The consequence is the likelihood that investment grade tax-exempt and corporate debt with maturities of less than ten years will return less than 2.5%. There remains the possibility of negative total returns if inflation rises, the Fed becomes more aggressive, and current bond investors head for the exit.

We thank our many clients for their loyalty and partnership and we wish all of our readers a prosperous 2016.

Economic And Financial Market Outlook 2015 Q4

“Fortunately, prospects for the U.S. economy appear solid.”

Fed Chair Janet Yellen (9/24/15)

Heading into the fourth quarter, there are growing concerns for the health of the global economy and the possibility that it may threaten the six plus year U.S. economic expansion and stock market advance. The S&P 500 Index, for example, has just endured its worst quarter in four years. Our view, however, is one of cautious optimism:

- We agree with the Federal Reserve’s forecast for continuing improvement in the U.S. economy.

- We recognize that the U.S. stock market could remain volatile in the near-term, yet anticipate an extension of the bull market in U.S. stocks through 2016.

- The UK, Euro area, and Japan are expected to enjoy accelerating GDP growth next year and their equity markets are attractively valued.

- China’s and India’s shifts to more modernized economies represent areas of strength and may contain investment opportunities with secular tailwinds within otherwise challenged emerging markets.

We recognize that the recent stock market turmoil reflects heightened risks to global financial markets, which we are carefully monitoring; further economic disappointments may require us to modify our views. At this point, however, one should not lose sight of the many positive factors that continue to support the global economy.

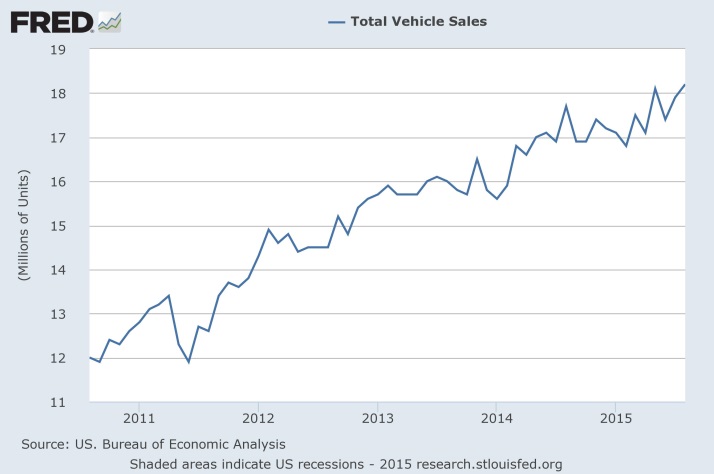

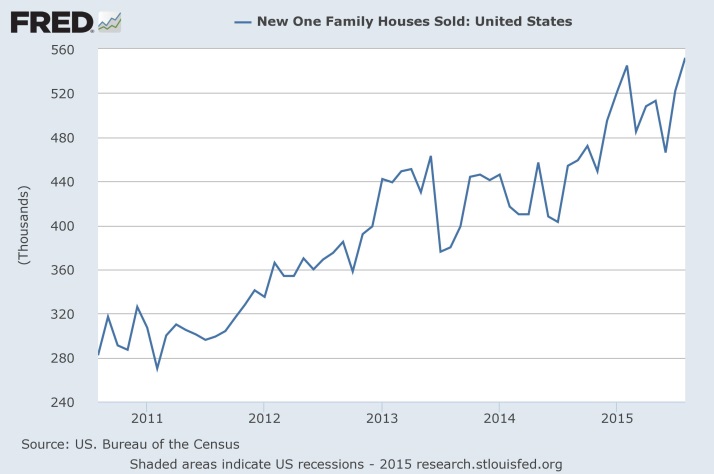

U.S. consumers, who represent about 70% of the economy, are supporting modest growth in domestic production. They are benefiting from reduced unemployment, falling energy prices, and rising real wages. Strong consumer confidence is evidenced by monthly car sales that reached a ten year high in September and a buoyant housing market.

Nevertheless, there are pockets of weakness in the U.S. economy. The energy sector is challenged by the collapse in oil and natural gas prices. U.S. exporters and manufacturers are threatened with soft international demand and the strong dollar. In sum, we forecast real GDP to rise from approximately 2.3% this year to 2.7% next year.

Our investment policy is to look beyond current conditions, which often are transitory, and to focus on the upcoming 6-12 month period. We have identified six fundamentals that historically have supported U.S. stock markets and that have been present since the beginning of the current bull market. We are optimistic that each of the following conditions will remain positive and will continue to support equity markets:

- A growing and preferably accelerating economy

- Healthy corporate earnings prospects in most economic sectors

- Low and stable inflation and interest rates

- An accommodative Federal Reserve

- An attractively, or at least fairly, valued market

- Relatively unappealing money market fund and bond alternatives

We recommend that investors favor growth companies that will continue to prosper in the current slow growth economic environment. In particular, consumer discretionary, consumer staples, select technology, and healthcare should perform well. We are currently less enthusiastic about commodity, energy, and multinational companies confronting a rising dollar and weaker international markets. We will continue to track key leading indicators that would warrant investment in these challenged sectors.

Developed country economies and markets on balance are promising. Economic prospects for Euro Area countries are looking up. The Greek Crisis has faded and the European Central Bank continues to implement accommodative policies. Similarly, Great Britain’s economy is solid and the Japanese policy makers have the political capital necessary to initiate additional stimulus measures to promote growth. All of these countries are benefiting from currency weakness relative to the dollar, as newly attractive exports are seeing stronger demand. Further, valuations for these developed equity markets are attractive. On the other hand, countries which are heavily dependent on commodity exports, such as Canada and Australia, are expected to continue to experience challenging conditions.

There is also a mixed outlook for emerging economies. On the positive side, India most likely will enjoy the strongest GDP growth of the world’s major economies and our forecast calls for over 7% growth in 2016. Slowing growth in China has worried investors and was a trigger for recent downward pressure on global equity markets. We recently addressed this problem in more detail (see our August 24 blog “A China Correction”), concluding that while manufacturing and export related industries will continue to contract, the Chinese consumer remains a source of strength and is becoming a major driver of the global economy. Similar to Canada and Australia, many of the emerging market countries are reliant on commodity exports which have plunged in price. We do not foresee a lasting recovery that supports investments in these countries. However, some companies in emerging markets have significant prospects for growth, especially those that benefit from the long-term economic developments in China and India.

The bond market continues to provide low yields and trade near all-time high prices. Treasury yields fell across the board last quarter as investors sought a safe haven amidst equity market turmoil. The demand for high-quality bonds remains strong. Junk bond yields have risen from multi-year lows due to concerns about the oil sector’s ability to pay its debts, but the yields are at best close to their long-term average. We do not recommend that investors take undue risk in this area. The Federal Reserve remains poised to raise rates sometime in the next six months and we expect this to slightly elevate bond yields, but strong demand for high grade fixed income will likely keep the benchmark 10-year Treasury yield under 3%.

Economic And Financial Market Outlook 2015 Q2

Our intermediate term (6-12 month) forecast for the U.S. and International economies and stock markets remains positive, but we continue to be cautious on the U.S. bond market.

- We expect global economic growth to strengthen in the second half of 2015. The U.S. is in the midst of a solid, moderate, self-sustaining expansion of about 3% GDP growth and conditions in Europe, Japan, and China will improve as growth initiatives implemented by policy makers take effect.

- Although we anticipate a higher U.S. market by later in the year, we note that concerns regarding first quarter earnings and Federal Reserve rate hikes may lead to heightened volatility in coming months.

- Many developed economies and markets, led by the Euro area and Japan, are recovering due to central bank stimulus programs, a decline in oil prices, and weakened currencies. Emerging economies, with the notable exception of India and possibly China, likely will continue to be troubled by soft economies, weak commodity prices, and looming Federal Reserve rate hikes.

- A strengthening U.S. economy, a modest rise in inflation, and Federal Reserve rate increases should slowly lift bond yields (and reduce bond prices) as the year advances.

The U.S. economy has entered a soft patch brought on by a combination of debilitating east coast blizzards and a west coast port shutdown. Nevertheless, the labor market has continued to make significant gains with the unemployment rate falling to 5.5%. While a March report from the Bureau of Labor Statistics confirmed the existence of the first quarter soft patch with nonfarm payroll employment growth well below expectations, it still represented a year-over-year increase of over 3 million jobs. We think employment gains and improving economic data will prompt the Federal Reserve to raise interest rates in the second half of the year, but we also think the rate increases will be too modest to negatively impact the recovery from the current slowdown.

The U.S. stock market will be challenged in coming months. One obstacle will be a projected year-over-year 6% decline in S&P 500 earnings in the first quarter at a time when the market itself is, arguably, modestly overvalued. This profits shortfall will, in part, be the consequence of disappointing energy earnings, which are expected to fall 63.5% year-over-year in the first quarter, and the sharp rise in the dollar, which will derail the earnings progress of many U.S. multinational companies. Excluding energy, the estimated earnings decline for S&P 500 companies that generate more than 50% of their sales from outside the U.S. is -1.3% (source: Factset). In addition, many investors are concerned that Federal Reserve rate increases will be a major negative for the stock market.

Despite the economic soft patch and the onset of the above headwinds, the U.S. market will continue to benefit from M&A activity, dividend increases, stock buybacks, and unattractive money market and bond yields. Further, there is a silver lining in the earnings picture. Companies which are outside the oil sector and have reduced international exposure are expected to grow earnings in the first quarter at a 5.9% rate, with more gains projected for the rest of the year (Factset). A gap may well open up between the winners and the losers in the market.

Going forward, we think investors will continue to focus on five salient trends that strongly impacted stock performance in the first quarter:

- International stock markets may continue to outperform the U.S. benchmark S&P 500 Index. As 2014 came to a close, the consensus view was that the U.S. stock market would outperform once again in 2015. Marietta’s last Outlook stated that international stocks could outperform if policy makers embarked on pro-growth stimulus measures. Since the December Fed meeting there have been over 45 easing moves around the world, including a massive quantitative easing program from the European Central Bank. The first quarter showed a sharp reversal of 2014 developments: the meager S&P 500 total return of 0.9% trailed the 3.5 % advance of the MSCI ACWI ex-U.S. Index. In contrast to 2014, taking a global perspective could be beneficial.

- A synchronized global economic acceleration in the second half of the year should stabilize commodity prices, including oil, but caution is warranted. Over the last 6 months, S&P 500 energy stocks are down 16.0%. A near-term forecast for the price of oil is unusually problematic. A recent Bloomberg article, “The Only Thing Oil Analysts Can Agree On Is Disagreement,” indicates the lack of consensus. Our best guess is for a modest recovery in oil prices IF oil companies cut production in the near future. In the meantime, energy company stocks will confront a dramatic plunge in earnings.

- The strong performance of healthcare companies merits an overweighting in the sector. In the first quarter of 2015, the best performing of ten industry sectors in the S&P 500 Index was healthcare with a return of 8.8%. The healthcare sector also was the best performer for the trailing one, three, and five year periods. The same pattern of outperformance extends to international healthcare companies. Clearly these strong gains reflect the aging populations of the developed countries; in the U.S. 10,000 baby boomers cross the 65 year milestone every day. Further, rising longevity and medical care improvements will increase the demand for healthcare products and services.

- Active stock selection, in contrast to passive investments in indexes, has returned to preeminence. Deutsche Bank recently reported that actively managed U.S. mutual funds are consistently outperforming their S&P 500 Index benchmark. To be sure, the S&P 500 Index, which in 2014 was among the most favored investments, not only is underperforming international benchmarks in 2015 but is also underperforming other benchmarks within the U.S. market. For example, in 2014, the S&P 500 led the S&P 400 midcap and the S&P 600 smallcap Index. In this year’s first quarter, the S&P 500’s meager gain was outpaced by smallcaps and midcaps. Furthermore, active stock selection tends to emphasize company earnings potential and momentum, and the Russell 1000 Growth Index (+3.4%) significantly outpaced the Russell 1000 Value Index (-1.3%) in the first quarter. Another noteworthy trend of this year’s first quarter has been the miserable performance of utilities stocks (-5.9%), whereas this sector soared 24.5% last calendar year. We think the utility sector will continue to reside in the lowest performance area of the S&P 500, which has been its home for the trailing three and five year periods.

- The strong dollar is damaging the prospects of large multinational company stocks. Numerous large multinational companies have indicated earnings problems. DuPont, IBM, Coca-Cola, Procter and Gamble, and other large U.S. corporate leaders have emphasized their declining competitiveness in international markets in contrast to the boost in profits enjoyed by international companies exporting into the U.S. One major reason for the rise of the dollar in 2014 was the weakness of key international economies, including the threat of deflation. In 2015, added pressure on the Yen and the Euro arose from central bank policies. In particular, the Japanese Yen has fallen 15.4% and the Euro has plunged 29.5% since last June 30. The widely anticipated rise in U.S. rates by the Fed, coupled with the expected monetary stimulus policies of foreign central banks, will tend to further strengthen the dollar and weaken key international currencies.

The combination of a strengthening U.S. economy, which brings with it the prospect of declining unemployment, rising real wages and tightening moves by the Federal Reserve, most likely will lead to a rise in bond yields. The increase, however, is likely to be limited by what we expect to be a cautious rate increase program by the Fed (we project a 0.50% – 0.75% Federal funds rate by year end) and by shockingly low yields in European bonds. As a consequence, we think the benchmark 10-year U.S. treasury yield will rise gradually from its current 1.9% to about 2.5% by the end of the year. We thus recommend short and intermediate maturities and, as always, investment grade quality.

Economic And Financial Market Outlook 2015 Q1

From all of us at Marietta, we wish you and your families a happy and healthy 2015. As we look ahead to the coming year, we highlight the main themes from our Outlook:

- Global economic growth will accelerate from 3.2% in 2014 to 3.7% in 2015. The driving force will be a strengthening U.S economy, which will be supported by improving conditions in Europe, Japan, and China as international policy makers adopt growth-oriented initiatives.

- Solid U.S. corporate profit growth of 6-9% will combine with other favorable market conditions to produce a corresponding 6-9% gain in the S&P 500 Index.

- The valuations of international stocks have fallen to attractive levels, and significant gains are possible if policy makers in Europe, Japan, and China are successful in restoring confidence in their slumping economies.

- Low inflation and low growth have kept bond yields low but in the second half of this year, U.S. bond market yields will rise slightly in response to the improving economy, stable inflation, and the Fed’s interest rate hikes.

The U.S. economy enters 2015 with its strongest momentum in over a decade. GDP growth of 5% in the third quarter is the largest increase since the third quarter of 2003, and the fourth quarter could mark the third consecutive quarter with growth above 4.5%. Our projection of 3.5% growth in 2015, which would be the largest annual increase this century, may prove too conservative. According to the Bureau of Labor Statistics, total non-farm payroll employment rose by 321,000 in November, and comes on top of an average monthly gain of 224,000 over the prior 12 months. The unemployment rate has declined from 7.0% in November 2013 to 5.8% in the latest survey. We expect monthly jobs gains above 225,000 in 2015 to lower further the unemployment rate to levels resulting in wage gains, thereby increasing middle class participation in economic growth. The dramatic plunge in the price of oil will provide an additional boost to consumer spending and also contribute to a broader social base for growth.

There are downside risks to our otherwise positive U.S. forecast. Three possible developments are most noteworthy. First, the Federal Reserve may be too aggressive in raising rates. Our view remains that the Fed, and in particular Chair Yellen, is committed to preserving the recovery and will be very cautious in raising short-term rates to only about 1% by the end of 2015 (see our blog “All Eyes on the Fed,” 9/12/2014). Rather, we think it is more likely that the Fed will be too hesitant rather than too aggressive. Second, the sharp drop in oil prices, which will benefit consumer spending, may severely hurt the U.S. oil industry, a key factor in supporting the economic recovery the past 5 years. We do not think the industry will be irreversibly damaged, but we do not forecast a significant oil price recovery in the near future (see our blog “Oil Spills: Winners and Losers,” (12/4/2014). Third, the recent slowdown in the international economies, especially Europe, Japan, and China, could intensify and hamper U.S. growth. Such a downturn, coupled with the strong dollar, would surely have a negative impact on U.S. exports, which accounts for about 13% of GDP. To the contrary, our view is that these slumping economies will recover rather than deteriorate in 2015.

Our key observation regarding the U.S. stock market is that it is poised for a sixth straight year of gains. The economy is accelerating and broadening, corporate profits are strong and above consensus expectations, inflation and interest rates are low, money-market funds and bonds are relatively unattractive, huge corporate cash coffers will continue to fund dividend increases, stock buybacks and M&A activity, the strong dollar is attracting foreign money into U.S. stocks, and valuations are reasonable. We expect the US market to rise 6-9%, in-line with corporate earnings. Our second observation is that the stock market will be more volatile. We anticipate a correction of at least 10% at some point during the year; we advise patience, discipline, and a 6-12 month perspective in responding to momentary market disruption. Third, we expect the economy-sensitive stocks of companies that provide goods and services to the domestic economy to outperform the multinational exporters.

The major international economies were disappointing in 2014, which contributed to disappointing equity markets. As the year came to a close, Europe was on the brink of recession and threatened with deflation, Japan’s recovery had faltered, and China’s growth had decelerated to its lowest level in 15 years. The vibrant U.S. economy and the weak euro and yen will help stabilize these second, third, and fourth largest economies in the world, but what is really needed is more growth-oriented policies from politicians and central banks. The ECB is prepared to embark on a massive quantitative easing program, likely to be announced in the first quarter, and Japanese Prime Minister Shinzo Abe has indicated that he will delay a sales tax hike and will continue with Japan’s unprecedented monetary stimulus program.

In recent years, international stock market returns have trailed the gains of U.S stock markets. We do not expect this pattern to shift in 2015 as the U.S. economy is very strong. However, there is a compelling case to continue to invest in international companies. Valuations of international companies are more attractive than their U.S. counterparts. The Japanese yen and the euro have weakened against the dollar, improving prospects for exporters. If policy makers come through with pro-growth initiatives, international stock markets could revalue at higher multiples which would result in strong stock market gains. While the road to recovery in international markets is likely to be bumpy, we think investors will be rewarded for having exposure to foreign companies, as there are many outstanding international growth companies whose stocks are very promising. We especially favor those that export into the U.S.

From May 1, 2013 through December 31, 2013, the yield on the benchmark 10-year U.S. Treasury note soared from 1.63% to 3.03% after then Fed Chair Ben Bernanke announced that the Fed would soon begin slowing the pace of quantitative easing. The near-unanimous forecast last year was that bond yields would rise further in 2014 as the Fed carried out its tapering policy of cutting back on its $85 billion per month bond purchasing program. Instead, the 10-year yield at the end of 2014 fell to 2.17%. A major contributor to this surprise was the collapse in the yields of European sovereign bonds as their economies weakened and deflation risks arose; the strong dollar was an additional reason for foreigners to buy U.S. bonds. The Fed rate hikes, a strengthening economy, and a moderate pickup in inflation should push yields up in 2015, but the strong dollar coupled with accommodative foreign central banks will likely continue to limit the increase. We expect the yield on the 10-year Treasury note to rise slightly from current low yields with the result that 2015 will be another year in which stocks outperform bonds.

Good Reading: Too Big To Fail

Good reading: Too Big To Fail: How Wall Street and Washington Fought to Save the Financial System and Themselves by Andrew Sorkin (Viking, 2009) 544 pp.

Four years have passed since the collapse of Bear Stearns, which ushered in twelve months of economic recession and financial market upheaval. To historians of the economic history of the United States and its financial markets, the importance of this period is rivaled only by the Crash of ’29 and the Great Depression. The causes and consequences of the 2008-09 crisis will be debated and continue to be controversial for decades to come, but the definitive narrative will likely remain Sorkin’s Too Big To Fail. In 544 pages of gripping day-by-day description of the major participants and developments, Sorkin admirably captures the pulse of Wall Street and Washington during these unforgettable months. The passage of four years provides a fresh perspective for a re-read of this to-be classic, and the book should be required reading for young professionals entering the investment industry.

The most dramatic and historic events of this chaotic year occurred in September of 2008. In less than 30 days, the financial landscape was forever altered. Mortgage giants Fannie Mae and Freddie Mac were taken over by the government. Lehman Brothers filed for bankruptcy. Merrill Lynch was sold to Bank of America in an eleventh-hour rescue. American International Group, the largest insurance company in the U.S., was put on government life support. Morgan Stanley and Goldman Sachs, in a desperate effort to avoid a similar fate, rushed to become bank holding companies thereby gaining unlimited access to the Federal Reserve’s discount window. The failure of Reserve Primary Fund triggered a panic run on money-market funds that threatened to disrupt the entire financial industry. The Dow Jones Industrials commenced a plunge with unprecedented volatility that by March of 2009 measured 50%.

Sorkin’s narrative centers on the indefatigable and at times frantic efforts of Treasury Secretary Paulson, Fed Chairman Bernanke, and New York Fed head Geithner to steer the financial system through this perfect storm. As they were painfully aware, their actions constituted the biggest intrusion of the U.S. government into free-market capitalism in the country’s history. For this they were and continue to be condemned by many politicians and market commentators. Their defense is that their actions were necessary to prevent financial and economic Armageddon. Bernanke stated in a critical meeting with skeptical congressional leaders: “I spent my career as an academic studying great depression. I can tell you from history that if we don’t act in a big way, you can expect another great depression, and this time it is going to be far, far worse.” In an oval office meeting with President Bush, Paulson said: “If we don’t act boldly, Mr. President, we could be in a depression deeper than the Great Depression.” Sorkin sides with Bernanke and Paulson: “To be sure, if the government had stood aside and done nothing as a parade of financial giants filed for bankruptcy, the result would have been a market cataclysm far worse than the one that actually took place.”

If Paulson, Bernanke, and Geithner were driven by a determination to save the U.S. economy, the heads of the major Wall Street firms and U.S. Banks were motivated by less lofty considerations. These titans of American finance worshipped at the altar of personal status, money, and power. On occasion they expressed concern for their shareholders and employees, but there is no mention of a desire to protect the public good. An example occurred in October, when the CEO’s of the 9 major firms were summoned by Paulson, Bernanke, and Geithner to a make-or-break meeting to approve an injection of taxpayer money into the financial system as a desperate step to restore stability. With tens of millions of American jobs at stake, the initial reaction of Merrill-Lynch CEO John Thain was to complain that such a step might result in changes in Wall Street executive compensation policies.

In an insightful epilogue penned in 2009, Sorkin offered the sober conclusion that the big Wall Street firms and banks remained too big to fail. He asserted further that ego, greed, and a “vulture capitalism” that abuses clients, which were a major ingredient in fomenting the turmoil, were still salient characteristics of Wall Street. Nevertheless, much has changed since the years and months leading up to 2008, and the likelihood of a similar financial upheaval is now remote. The overheated housing market and abuses in the mortgage industry, which precipitated the crisis, now seem to be a unique phenomenon of the past. The banks and investment firms are much better capitalized, much more sensitive to risk, and far more heavily regulated. The government has also learned from the experience, and is far more vigilant and better equipped to identify and respond to excesses before they imperil the entire financial structure. In retrospect, the cataclysm of 2008-09 created widespread economic suffering for millions of Americans, but it also provided a beneficial wake-up call. Sorkin’s book will be a reminder to generations to come of how perilous the situation was and thereby serve as a deterrent to a future crisis.

Good Reading: The Big Short

Good Reading: Lords of Finance

Good reading: Lords of Finance: The Bankers Who Broke The World by Liaquat Ahamed (Penguin Press, 2009), 505 pp.

For investors tracking the ongoing efforts of governments and central banks to battle recessionary pressures and engineer a global economic recovery, we recommend strongly Ahamed’s informed and captivating Lords of Finance. The book focuses on the largely successful efforts of the central bankers of the U.S., England, France and Germany to restore economic and currency stability following the chaos of World War I and their subsequent policy mistakes that helped bring on the Great Depression. These bankers were men of sharply divergent backgrounds and personalities, and they were committed to the sometimes conflicting interests of their respective countries. Nevertheless, they managed at critical moments in the 1920s to coordinate policies, overcome the obstacles thrown in their path by the politicians, and weather one crisis after another. The glue that held them together was a near-religious faith in the gold standard, which they managed to restore after World War I and to maintain for a tumultuous decade. Ironically, the author argues that it was their slavish adherence to this inflexible gold standard that ultimately triggered the Depression and in the process tragically ruined their careers and reputations. For the author, who is no fan of the gold standard, the heroes of the book are John Maynard Keynes, the brilliant and controversial English critic of these central bankers, and Franklin Roosevelt, who rejected the insistent advice of his economic advisors and took the U.S. off the gold standard at the depths of the Depression in 1933.

Readers will enjoy and profit from Lords of Finance even if they are not sophisticated in economics or historians of the Great Depression. Ahamed, whose background includes a stint at the World Bank, patiently and expertly explains the formation of the Federal Reserve and its inner workings through the 1920s and 1930s. He also provides a clear explanation of the gold standard with its benefits and limitations, and places the economic and currency crises within a broader political and social historical context. Readers will also appreciate the ability of the author to paint personality portraits of the major protagonists. The book is a useful antidote to the currently fashionable thesis that seismic economic events, such as the Great Depression, are the consequence of largely impersonal and unavoidable political, social and demographic trends.

In a very instructive epilogue, Ahamed compares the Great Depression with the 2008-2009 global economic and financial crisis. Although he acknowledges the two events share many of the same characteristics, he concludes that the differences outweigh the similarities. His major point is that The Depression was the consequence of the misguided policies of politicians and central bankers; modern policy makers, enlightened by the errors of their predecessors, are now pursuing a contrary set of policies that will result in a more favorable conclusion.

The book deserves its accolade as the Financial Times and Goldman Sachs 2009 business book of the year.