Economic and Financial Market Outlook Q3 2024

Overview: Settling in for a Soft Landing

In our April 9 Outlook, we identified two major trends that support a further advance in US stocks: a gradual decline in inflation pressures and a resilient economy heading toward a soft landing. We reaffirm this positive forecast: annualized core PCE inflation will continue its downward trend from the current 2.8% rate to about 2.0% by the end of the year. In response, the Federal Reserve will commence interest rate cuts. We also anticipate the labor market and consumer spending to remain strong enough to avoid a contraction and provide for robust corporate profit gains.

US Economy: A Tale of Two Consumers

The US economy continues to expand. The Atlanta Fed’s GDPNow model forecasts 1.7% GDP growth for the second quarter, slightly above the first quarter’s 1.4%. We expect GDP to pick up slightly in the second half of the year, resulting in a solid 2.3% for 2024. Future growth will benefit from a reduction in inflation and interest rates. Easing borrowing costs will give consumers relief from relentless inflation anxiety and, in particular, boost the housing and auto markets. The promise of a more stable long-term economic future would also strengthen CEO confidence to increase capital expenditure and pursue mergers, acquisitions, and initial public offerings.

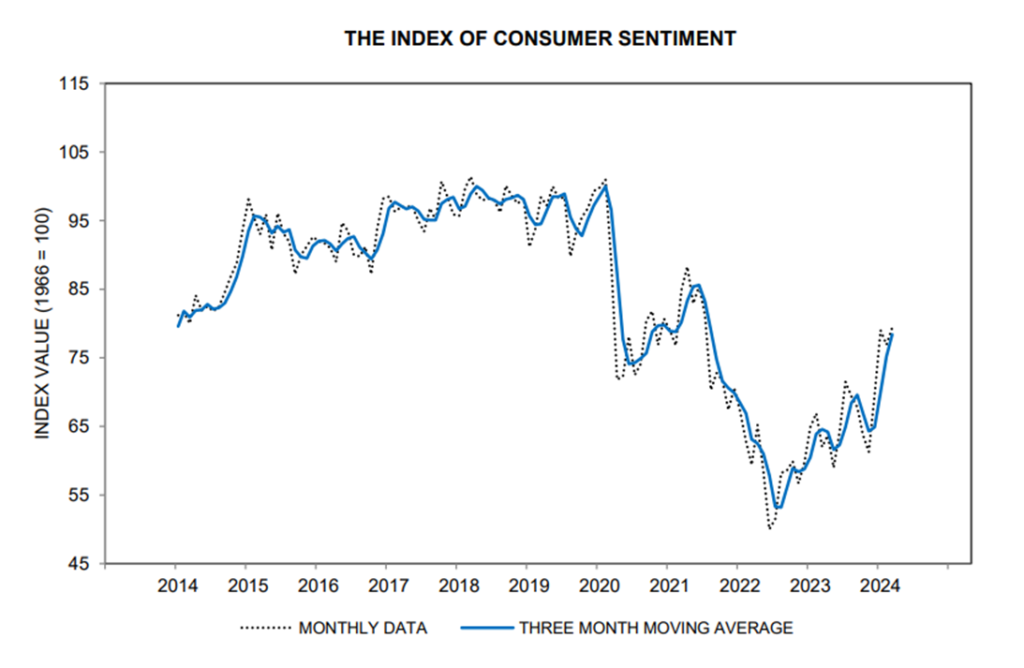

The US consumer provides the foundation for future growth. Despite higher borrowing costs, we expect consumer spending, driven by a strong labor market and real wage gains, to hold steady. We think total nonfarm payroll employment, which increased by 206,000 in June, will continue to expand and the unemployment rate will remain close to its current 4.1%. Nevertheless, we acknowledge that there are pockets of weakness in consumer spending. The Conference Board Consumer Confidence Index dipped in June to 100.4 from 102.0 in May and has been trending lower for three of the past four months. Similarly, the University of Michigan Index of Consumer Sentiment fell 1.3% in June after plummeting 13.0% in May. Most problematic is the economic drag of consumers who are struggling with the four-year cumulative increase in inflation, especially in living essentials such as housing, transportation, and food. Many renters and new homeowners are burdened with sky-high mortgages and rent. They are in sharp contrast to the many homeowners who are thriving with refinanced sub-3.0% fixed mortgages and real wage gains.

US Stock Market: Concentrated Gains

The S&P 500 Index has enjoyed strong performance in the first half of 2024, though the second quarter brought increased volatility, including a 5% pullback in April. This year’s positive returns should hold up if estimates for corporate profits meet expectations: aggregate S&P 500 earnings are projected to log a double-digit gain in 2024, including an impressive acceleration to 17.6% in the fourth quarter (Factset Earnings Insight, June 12, 2024). Profits at these elevated levels should more than justify higher than average P/E ratios. However, a closer look at the market’s internal dynamics reveals an unusual market, with concentrated gains among the “Magnificent 7” stocks. Outsized performance in the first half extends to those companies with exposure to Artificial Intelligence (AI). We recommend that investors consider holding at least some AI securities in their portfolios. While this high growth sector exhibits some bubble-like characteristics, we believe it is transitioning into a “prove it” phase: companies that can demonstrate tangible benefits and market share gains are likely to continue outperforming, whereas those that disappoint will struggle to maintain investor enthusiasm. This dynamic suggests a selective approach to AI-related investments is warranted. Narrow market leadership often has a short shelf-life, but a negative ending is not a foregone conclusion. A broadening rally that rewards companies in diverse industries for their earnings and revenue progress would increase the prospect of a multi-year bull market.

The recent performance of major US market benchmarks indicates the extent to which the S&P 500 and the technology heavy NASDAQ Composite are not representative of US stocks as a whole. The gap between the S&P 500, in which the Magnificent 7 stocks account for about 30% of performance, and the S&P 500 equal weighted stocks is also noteworthy. Investors needed to be concentrated in a few large cap stocks, and technology stocks in particular, to have enjoyed outperformance. Investors with diversified exposure to the full range of US stocks have likely underperformed.

| Recent Performance of US Market Indices | |||

|---|---|---|---|

| Index | 6 Month | 12 Month | P/E Ratio (NTM) |

| NASDAQ | 18.1% | 28.6% | 28.3 |

| S&P 500 | 14.5% | 22.7% | 21.2 |

| S&P MidCap 400 | 5.3% | 11.7% | 15.0 |

| S&P 500 Equal Weight | 4.1% | 9.6% | 16.3 |

| Dow Jones Industrials | 3.8% | 13.7% | 17.9 |

| Russell 2000 | 1.0% | 8.4% | 24.5 |

| S&P SmallCap 600 | -1.6% | 6.6% | 14.0 |

International Market: Opportunities Amid Recovery

International markets present a mixed landscape. China’s recovery remains fragile, facing headwinds from both domestic economic challenges and global trade dynamics. Unlike the S&P 500 and NASDAQ, international stock markets have not experienced an outsized performance driven by AI investments. This discrepancy creates a more attractive entry point for value-focused investors. A positive development is the synchronized monetary policy stimulus being implemented by some major international central banks: for example, Canada and the European Union have already embarked on an interest rate cutting cycle, which should boost economic activity and sentiment. An interesting observation has been the outperformance of emerging markets compared with developed markets year to date, as measured by the iShares EEM and EFA exchange traded funds. We are watching this closely, as this scenario has sometimes preceded a sustainable rally in international stocks.

Bond Market: Policy Shift on the Horizon

Interest rates remain elevated due to the Fed’s current restrictive policy. However, with rate cuts anticipated in the near future, we expect benchmark yields to fall modestly and to remain lower throughout the easing policy cycle. High yields on money market instruments will likely drop swiftly, potentially raising demand for fixed-income securities and equities. Bond investors or those with balanced portfolios should consider fully investing their allocations before the first Fed cut to capitalize on the current higher yields. Given the lack of reward for extending duration, our preferred strategy is to focus on short- to moderate-duration bonds with a laddered approach. This strategy should help investors manage interest rate risk while optimizing returns in a shifting rate environment.

Economic and Financial Market Outlook Q2 2024

Can We Anticipate More Good News?

Global investor focus is on the US economy and stock markets, which enjoyed a very strong gain in the first quarter. Can we anticipate more good news? Building on the Marietta Investment Team’s January 19 Outlook, we reaffirm its major points: there are two positive developments which suggest a further, sustainable market advance. First, inflation continues its slow decline, which will permit the Federal Reserve to introduce interest rate cuts this summer. Second, healthy economic growth, based on robust consumer spending, will continue for the duration of the year and fuel strong corporate earnings. Short-term, a market correction, limited in duration and severity, is possible and perhaps overdue, but long-term these two powerful stimulants point to further gains in the stock market and possibly a multi-year bull market.

US Economic Resilience Despite Inflation Above Target

The trajectory of inflation, which peaked at 9.1% in July 2022, has moderated to its current level of 3.2% (Bureau of Labor Statistics), representing a significant departure from the inflationary spikes experienced during the COVID period. Although inflation measures remain above the target, the Fed is evidently content with the progress made and forecasts three interest rate cuts this year. At the March 20 press conference, Fed Chair Jay Powell noted, “inflation has come way down, and that gives us the ability to approach this question carefully and feel more confident that inflation is moving down sustainably.” (AP News) This development is poised to support equity valuations as investors cheer lower interest rates.

At the heart of ongoing US economic stability is consumer spending, which constitutes nearly 70% of GDP. Despite challenges from elevated inflation and interest rates, consumer spending has remained robust, contributing to fourth quarter GDP growth of 3.4% and a 2.5% growth rate for 2023. The Atlanta Fed’s current estimate for the first quarter suggests a continuation of this trend, with a projected growth rate of 2.8%. Sentiment, while still below pre-COVID highs, has improved. The University of Michigan Survey of Consumers final March results indicate a +3.3% change month over month and a significant +28.1% surge year over year.

This enduring consumer strength, underscored by real wage growth and low unemployment rates, establishes a solid foundation for sustained future spending. Consumer debt is rising but is offset by real wage growth and is not yet alarming. Despite the hurdles posed by higher borrowing costs, this backdrop paints a cautiously optimistic picture for the US economy. A further decline in interest rates, prompted by potential future Fed rate cuts, would reinforce this positive trend.

US Equities: Balancing Growth and Valuation

US equity markets took off in the first quarter in response to declining inflation, robust economic growth, and ascending corporate earnings. With these underlying fundamentals expected to remain steady, the momentum of the current stock rally looks sustainable, with S&P 500 earnings expected to rise 11.0% in 2024 (FactSet Earnings Insight). We maintain our forecast that we are in the early stages of a new, multi-year bull market. Market internals, however, reveal a more nuanced environment for equities. The rally has notably been led by high growth sectors such as Artificial Intelligence, resulting in a concentrated market driven by a handful of companies. This phenomenon has been exacerbated by the ongoing disparity in performance between mega-cap stocks and smaller-cap companies. While market concentration is not inherently problematic, a broader rally across more industry sectors would be indicative of a more robust investment climate. Somewhat more concerning, valuations have risen to a cautionary level, though this could be justified if corporate earnings materialize as anticipated. Elevated valuations pose the risk of sharp negative market responses to adverse news. Considering that, on average, there is a 10%+ downturn every 14 months, a correction in the near future would not be surprising. If this does occur, we would anticipate it to be brief, mild, and perhaps even constructive for market health. While our outlook remains optimistic in the long term, we note that equity gains in the next six months will likely moderate after a notably strong first quarter.

International Recovery

Our forecast for the global economy is gradually improving and we now project a GDP advance of 3.2% in 2024 and 3.4% in 2025. The catalyst for our modest optimism is above-expectation growth in the US and China, supported by another year of healthy growth from India. Apart from the US, GDP gains in most developed countries will be sluggish and remain well below pre-pandemic levels. In particular, the Euro Area, which is recovering from a shallow recession in 2023, will need ECB interest rate cuts and a pickup in US and China trade to achieve 1.0% growth. A potential bright spot is Japan, where policymakers are promising corporate governance reforms, yet it is still difficult to anticipate a GDP growth rate above 1.0% in 2024.

We are keeping a close eye on China and emerging economies, where equity markets have been underperforming for years. The Conference Board estimates emerging and developing countries as a group to grow at a 4.0-4.5% rate in 2024. They emphasize that 70% of global GDP growth from 2025-2030 will be attributable to emerging economies, and they will “remain the key global growth engine.” China policymakers in March established a 5.0% GDP growth target for 2024, which will be a challenge unless the policymakers implement major stimulus. If China exceeds this target, emerging market equities will become increasingly attractive.

In past outlooks we have recommended investments in individual international-based equities rather than increasing international exposure through country ETFs. We confirm this view, as there are compelling international stocks with strong management teams, healthy balance sheets, and solid growth prospects trading at attractive valuations.

Bond Market Stabilization

The Fed is maintaining its 2.0% core inflation target, which we think may be achieved by the end of the year. In this event, short-term rates would fall substantially but we do not expect a similar decline in longer-term rates. For example, we think the benchmark 10-year US Treasury Note will stabilize around 4.0%, or about 2.0% above the inflation rate. It is likely that financial markets will celebrate the re-emergence of a normal yield curve (where short-term rates are below long-term rates) and a Fed policy that is considered neither stimulative nor restrictive. The major risk to our forecast is that stronger than anticipated inflation and growth will trigger a delay in rate cuts.

Economic and Financial Market Outlook Q1 2024

Summary

The global economy is approaching the end of a four-year period when financial markets were driven by concerns about the COVID pandemic, inflation, central bank policies, a spike in interest rates, and the omnipresent threat of a recession. We think these issues are largely behind us. In the final phase of this period, which will extend through the first half of 2024, a further decline in inflation will enable key central banks to reduce restrictive policies. In the second half of 2024, we expect the emergence of a new period of relatively stable economic growth and rising corporate profits that will create propitious conditions for global equities.

Soft Landing in Sight

The U.S. is poised to lead in this transition. In recent Outlooks we maintained the forecast of an economic soft-landing in which inflation would steadily recede and the economy would avoid recession. In 2023 we were correct: GDP rose 4.9% in the third quarter, and a preliminary estimate for the fourth quarter is 2.3% growth. Resilient consumer confidence and spending supported by a strong labor market should continue into 2024. A decline in core inflation to approximately 2.5% and two 25 bps cuts in short-term rates by summer will also help GDP remain positive. The second half of the year holds even more promise for steady growth and lower, less volatile rates. Overall, we now estimate 2024 GDP growth will be 2.0% and inflation will near the 2.0% target of the Federal Reserve, allowing the Fed to further reduce rates in the second half. We expect to no longer see an inverted yield curve by year-end.

Is This the Beginning of a New Bull Market?

The US stock market has considerable momentum entering 2024 and the outlook remains bright. In November and December, optimism spread that lower inflation and interest rates along with higher GDP and earnings lay down the road, and the result was double-digit rallies in the major US market benchmarks. The question now is whether stocks are overvalued and vulnerable to another large setback, or whether the current rally is the beginning of more gains and possibly a multi-year bull market. The answer will depend on the strength of corporate profits. Earnings for the S&P 500 Index grew 4.9% in the 3rd quarter of 2023 and the consensus forecast for the 4th quarter is 2.4%. We think the recovering economy in 2024 will be strong enough for earnings to rise 10-12%. The market in our view is fully valued but not overvalued, and thus will rise at the same pace as earnings. This will be welcome news for stock investors who have experienced extraordinary volatility over the past 4 years: two declines of at least 25% separated by a dizzying rally that doubled many equity benchmarks. We think their patience for reduced volatility is about to be rewarded.

A Global Rebound

Major international economies, with the notable exception of China, will likely experience the same positive developments occurring in the US. Moderation of inflation will enable acceleration of GDP growth ex-China, though the Eurozone will be mired in a soft patch for much of the year before picking up going into 2025. We maintain a cautious view towards China. Stimulus was less than expected and insufficient to boost their economy. The OECD forecasts China’s GDP growth to slow to 4.7% in 2024, down from 5.2% in 2023. We questioned in our last Outlook whether China has the determination to take the necessary steps to restore growth. So far the answer appears to be that they do not. Overall, we are encouraged that global growth appears to be making a favorable turn but we note that international economies comparatively are not as well positioned as the US. Therefore, investors looking for international exposure should continue to focus on companies that are experiencing positive secular trends. There is still potential for attractive returns in these markets with an average multiple of 12.8x forward earnings for companies in the ACWI ex-US index.

There Are Still Reasons for Caution

Despite the many positives for equity markets, we must still caution against complacency. The greatest threats are less likely to come from any of the problems of the past 4 years (pandemic, inflation, interest rates, etc.), but rather from new issues emerging. Foremost, we are sensitive to the potential for international conflict to disrupt trade and supply chains. We are closely monitoring Ukraine, Israel and the broader Middle East, and Taiwan. Global business seems to be navigating these situations successfully so far but escalation, particularly in the Middle East and Taiwan, would have a major negative impact on the global economy as those areas contain the world’s most important shipping routes. Second, commercial real estate is still struggling with the post-covid trend of remote work and lower demand for office space. While we believe that this will be a drag on the real estate and finance sectors of the market we do not see this spilling over into a crisis for the whole economy. Nevertheless, there are many unknowns about the exposure to assets that will inevitably see their values decline. This warrants close monitoring as well.

Excitement Over Higher Yields May Be Short-lived

The stock market rally of last November and December coincided with a sharp decline in bond yields. The table below shows peak US Treasury yields (occurring in October) and the subsequent drop.

| Bond Term | Dec. 31 2022 | 2023 Peak | Dec. 29, 2023 |

| 90 Day T-Bills | 4.41% | 5.50% | 5.35% |

| 2-Year T Notes | 4.42 % | 5.26% | 4.45% |

| 5-Year T Notes | 4.00% | 4.96% | 3.85% |

| 10-Yr T Notes | 3.88% | 4.99% | 3.88% |

The yield on the benchmark 10-year T Note, for example, fell from 4.99% to 3.88%. In the near term, we forecast additional declines across the yield curve, with the largest declines occurring in the shortest maturities. We expect this will finally bring to an end the inverted yield curve, which has generated much of the recession speculation in recent years. With this outlook, fixed-income investors may wish to lock in these yields to protect against future drops in rates. In our view though, we think a stronger and more stable economy will eventually lead to a rise in longer-term yields. We are not yet ready to advise increasing longer duration holdings and as always we recommend staying with high-quality issues. Lastly, we note that if inflation does fall to the Fed’s 2% target, the days of money-market funds and Treasury bills yielding over 5% will be over. When this occurs, trillions of dollars will seek alternative investments, including stocks.

Economic and Financial Market Outlook Q4 2023

Cautious Optimism

Our outlook for the US economy and stock market remains constructive, albeit tempered by rising oil prices and long-term treasury yields surging to levels not seen since 2006. Another potential threat is that Federal Reserve policy will be too restrictive by maintaining high interest rates for too long. Despite these headwinds, our 2024 forecast is for US GDP to grow 2.0%, core PCE inflation to soften to 2.0%, and stock market indices to increase in tandem with a projected 10-12% expansion in corporate profits. It is more difficult to hold a positive outlook for the major international economies and markets, with China struggling to control a property crisis and Europe facing stagflation. Yet there are select companies with robust earnings growth which remain appealing. In the bond market, short-term interest rates offer appealing yield and stability, but long-term interest rates carry the risk of moving higher and lowering the value of longer maturity bonds.

Third Quarter Blues

At the writing of our last Outlook on July 14, we expressed an expectation for an economic soft landing in the US. This included slowing growth but avoiding recession due to low unemployment, further easing of inflationary pressures, and a resilient consumer. In August and September, data indicated the economy might actually be accelerating. Retail sales were strong, the unemployment rate remained near its five-decade low, job openings were plentiful, the Manufacturing Purchasing Manager’s Index rose to a ten-month high, and the construction industry was surprisingly healthy. Forecasters rushed to increase GDP expectations. The Atlanta Fed’s GDPNow reading for the third quarter, for example, jumped to 5.1%. Suddenly, the fear that the economy was slumping and headed for a recession was replaced by a fear that the too-hot economy would trigger long lasting inflation. The Fed fueled this view by hiking the benchmark interest rate by 25 basis points and suggesting that rates would remain at elevated levels well into 2024. Long-term bond yields swiftly adjusted higher, which if sustained could burden entities depending on revolving debt. In short, the prospect rose that the Fed would push the economy into recession by keeping rates too high for too long. In September, this dismal mood was exacerbated by the 30% jump in oil prices, labor strikes stoking fears of a wage-price spiral, a potential government shutdown, and further evidence that the Chinese economy had not improved.

A Solid Foundation

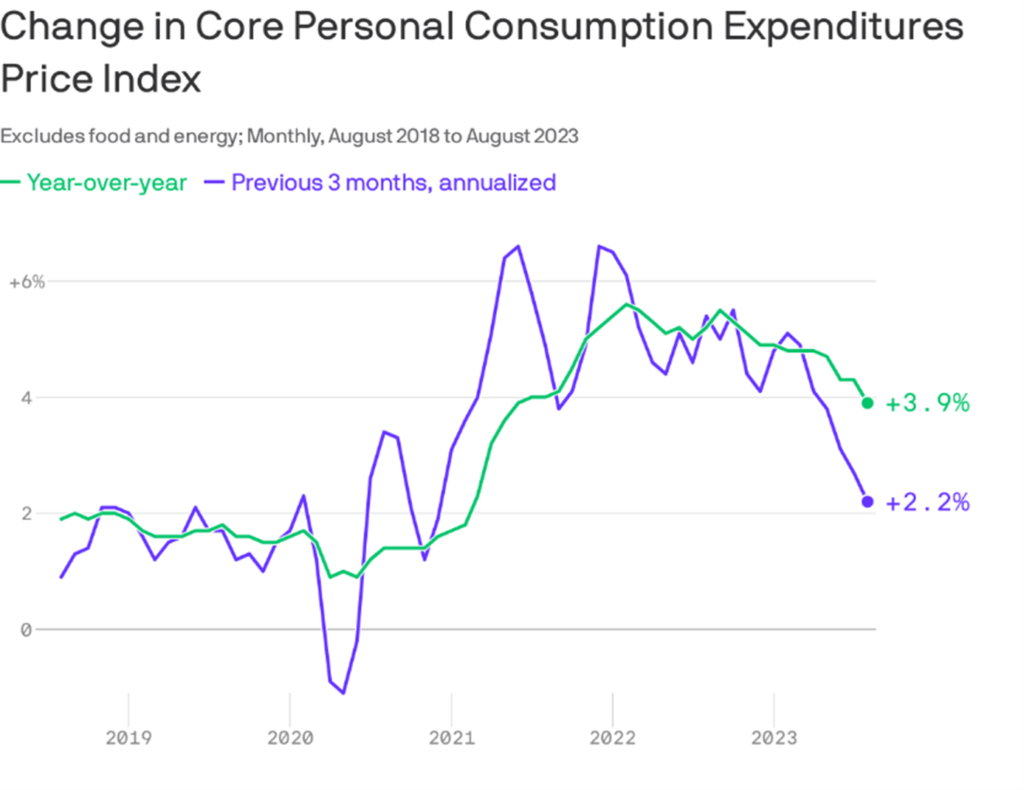

The two pillars of a positive forecast for 2024, which we think will gradually overcome the negative scenarios, are a constructive view of inflation and a continuing expectation of moderate economic growth. The reality is that the Fed’s preferred measure of inflation has been coming down steadily for over a year with a drop from 6.3% to 3.9%: the latest three-month annualized rate shows a near-target 2.2%.

Data: Bureau of Economic Analysis; Chart: Axios Visuals

Easing inflation makes sense considering its main causes. The surge since 2020 was a direct consequence of COVID-19 and the government’s response with unprecedented transfer payments and shutdowns. In contrast, today COVID-19 no longer has a significant economic impact and the stimulus spending has come to an end. We think it is highly likely that inflation will decline to pre-COVID levels by 2025. The case for moderate GDP growth next year is supported by this year’s impressive economy in the face of a Fed Funds rate rising to 5.5%. High borrowing costs will be a drag on the economy but not sufficient to result in a downturn. Among other positives, the labor market and consumer spending may well be slowed but not reversed.

Will Stocks Recover or Retreat?

If our forecasts on inflation and the economy prove accurate, it is likely that we are on the brink of a new bull market. With inflation subsiding in the fourth quarter, we anticipate at most one more quarter-point rate hike from the Fed later this year, followed by a prolonged pause. Less threatening inflation and Fed policy will provide a huge relief to equity markets. Also key will be a return to corporate earnings growth. After three consecutive quarters of contraction, S&P 500 profits are set to accelerate to a double-digit gain in 2024. A claim often used to support the negative forecast is that the market has risen to an unsustainable level and that valuations are excessive. We noted in our last Outlook that the performance of the S&P 500 Index was not representative of the overall stock market. This situation continued through the third quarter, with the S&P 500 +13.1% year to date, whereas the Dow Jones Industrial Average and the Russell 2000 reported modest gains of +1.1% and +2.5% respectively. The S&P Small Cap 600 Index was +0.8%. From this perspective, valuations are not currently excessive. The S&P 500 trades at 17.9x forward earnings, below the five-year average (FactSet Earnings Insight, 9/29/23). We conclude that many quality stocks have attractive valuations, and they will respond favorably to good earnings reports. We prefer companies with strong earnings prospects, especially those that thrive on improving economic conditions in the industrial, technology, and consumer discretion sectors.

International Obstacles

In its latest World Economic Outlook (10/10/23), the International Monetary Fund forecast global growth of 3.0% in 2023 and 2.9% in 2024, well below the 3.8% average over the 2000-2019 period. Numerous economic and geopolitical factors account for this discouraging outlook, but the principal factors are the continuing slump in China and the wide-reaching impact of EU and US central bank policies to reduce inflation. The IMF expects Chinese growth to rebound modestly to 5.0% next year from a below-target 3.0% in 2023 but anticipates a slower recovery in Europe, with the euro area narrowly avoiding recession this year followed by a modest 1.2% gain in 2024. Slightly less pessimistic is the IMF’s expectation of a future decline in global inflation from a high of 8.7% in 2022 to 6.9% in 2023 to a still lofty 5.8% in 2024. We accept the somewhat gloomy prognostications of the IMF but are hopeful that there will be an upside surprise if the policymakers in China and Europe are more successful.

Entering 2023, China’s economy was expected to rebound strongly following the restrictive “zero-COVID” shutdowns. Consumer spending flourished for a brief period, but then deteriorated into weak growth and deflation. During the summer, the policymakers responded with surprisingly weak and ineffective measures. The once prosperous property market is perhaps the greatest problem, but there is also a sharp downturn in exports and industrial production. Chinese consumers have evidently lost confidence: retail sales are slumping, employment is uncertain, and wages are stagnant. In the past, such as in 2008, the Chinese government responded quickly and decisively with successful stimulus policies. Why are policymakers so inactive this time? In a lengthy cover article, “Xi’s Failing Model: Why He Won’t Fix China’s Economy,” The Economist (8/26/23) rendered a verdict that, “Mr. Xi lacks the credibility or focus of previous leaders.” Our view is that the Chinese authorities have the ability to restore prosperity as in past crises, but we do not know whether they have the determination.

The euro area’s economic woes are more similar to the US than China. Inflation is a central problem, which is higher and descending more slowly than in the US. The ECB is determined to stamp out inflation with restrictive measures, but they run the serious risk of pushing the economy into a recession, convincing some observers that they would prefer a hard landing with economic pain rather than failing to reduce inflation. At this point, unemployment remains at a record low while the demand for goods and services is weak. The worst may well be behind us and baked into current forecasts, but there is little evidence of any imminent improvement. Investors should focus on companies that have been able to grow earnings and revenue in the current challenging environment, as we do not have good visibility on when the current headwinds will abate.

Relief for Bond Investors

The major surprise in the third quarter was long-term interest rates rising to decade highs, with the 10-year Treasury yield moving above 4.5%. This has increased the attractiveness of bonds as an investment. We expect long- and short-term rates to remain near these levels throughout 2024. However, we continue to favor bonds maturing within five years as longer bonds still carry excessive interest rate risk. We also recommend maintaining investments in high quality issues rather than junk bonds and view equity markets as a more appropriate asset to seek higher returns in a balanced portfolio.

Economic and Financial Market Outlook Q3 2023

Prepare for a Soft Landing

The global economy continues to slow, but the US and euro area should avoid recession, albeit narrowly. We expect a positive global GDP growth surprise of 3.0% to 3.5% for 2023, based in part on the anticipated boost from coming stimulus in China. In the second quarter the views of the most probable US scenario shifted from recession to “soft landing,” which reflected the capacity of the economy to withstand inflation and higher interest rates. We now estimate the likelihood of a recession to be below 20%. The improved environment raises prospects for the US stock market and reduces the probability of a renewed bear market. We are cautiously optimistic regarding a further advance of the S&P 500 Index, but we note that this Index over the last six months has featured extreme divergence in the performance of different industry sectors and market capitalizations. This is unhealthy, and a near-term correction is possible. The arrival of more favorable macro conditions should broaden participation and makes a future market advance more sustainable.

US Economy Refuses to Quit

So far this year, the US economy has exhibited surprising strength. In the first half of 2023 there was plenty of bad news: the Federal Reserve hiked rate above expectations, inflation declined at a disappointingly slow pace, major banks failed, the government tottered on the brink of default, international economies were weaker than anticipated, manufacturing indicators contracted, and recession predictions were ubiquitous. Yet the economy continued to grow. US GDP rose 2.0% in the first quarter, and we expect a similar result for the second quarter. The major support for the economy has been the labor market: the unemployment rate has settled near a 70-year low and job creation has been vibrant. Home prices and sales have remained firm despite a sharp increase in mortgage rates, and consumer sentiment and spending data have been encouraging. As the quarter drew to a close, there was a notable jump in optimism that the soft-landing scenario was the most probable.

What does a soft-landing look like?

Over the next two quarters, we expect GDP growth to approach 0.0% but remain positive, as the lagging impact of previous Fed rate hikes takes its toll. Annual CPI inflation will continue to decline gradually from its current 4.0% but remain above the Fed’s 2.0% target. We estimate two more quarter point rate increases, the first in July and the second in September. By the end of the third quarter, the Fed will be satisfied with the reduction of inflation from its peak of 8.3% in 2022 to below 3.0% and decide to pause rather than raise rates further but we do not expect any decisions to lower rates until well into 2024. Despite higher rates, the labor market will stay strong with the unemployment rate below 4.0%. As was true in the first half, this positive scenario will be driven by the resilience of consumers and businesses spending and investing despite the headwinds of inflation and worries of an impending recession. The housing and auto markets should remain healthy. Recent, successful stress tests administered to banks have been encouraging and we think another banking crisis is unlikely. While all of this should be welcomed as good news, conditions are intended to remain tight to slow the economy and GDP will be on the cusp of contraction. There remains a lot of progress to be made before we are on a path of healthy, sustainable growth.

US Stock Market Resilient

The unexpected strength of the US economy drove equity markets to advance in the first half of the year. In the face of a slowing economy and a forecasted recession, high inflation and rising interest rates, and fear of government default, the market rally was certainly a surprise to investors. While the S&P 500 index had the strongest performance, most broad market indexes provided positive if unspectacular single digit returns:

| 12/31/2022 - 6/30/2023 Total Return | |

|---|---|

| S&P 500 Equal Weighted Index | 7.0% |

| S&P Mid Cap 400 | 8.8% |

| S&P Small Cap 600 | 6.0% |

| Russell 2000 | 8.1% |

| Dow Jones Industrial Average | 3.8% |

| Source: FactSet |

7 of the 10 Industry sectors of the S&P 500 Index returned less than 10%, and 5 were negative or flat: consumer staples (0.0%), financials (-1.5%), health care (-2.3%), utilities (-7.2%), and energy (-7.3%).

In sharp contrast is the truly remarkable performance of technology stocks and especially the largest stocks by market capitalization (see our 6/2/23 blog, “2023 US Stock Markets: The Year of the Giant.”). For the six-month period, the technology heavy NASDAQ Composite and the information technology sector of the S&P 500 Index rocketed 31.7% and 42.1% respectively, and the six largest companies measured by market capitalization rose an average of 85.3%: Alphabet 36.3%, Amazon 55.2%, Apple 49.7%, Meta 138.5%, Microsoft 42.7%, and Nvidia 189.5%. These giant companies have a combined market cap above $9.4 trillion, or about 26% of the total S&P 500 Index. This is the reason the S&P 500 Index (+15.9%) was such an outlier in the first half. As we pointed out in the blog, the S&P 500 Index was not representative of overall stock markets and well-diversified portfolios saw more modest single digit returns in line with most other indexes.

For the rest of the year, we expect the path of inflation and the response of the Fed to be the major focus of stock investors. Based on our forecast for a continued decline in inflation, we expect the market rally to extend through the end of the year. Although additional rate hikes are coming, investors expect this and the modest increases should not pose a significantly larger obstacle than the previous 500 bps. We project corporate earnings will turn positive again in the third quarter and accelerate in the fourth quarter, justifying current higher price multiples. Our positive forecast includes a broadening of market participation away from a reliance on the largest stocks mentioned above.

International Green Shoots

In China, the financial market situation has turned ambiguous after a brief surge earlier this year. A short-lived rally in stocks faded as the economic headwinds arose. In response, the government has resorted to stimulus measures to invigorate the economy, and we anticipate more in the pipeline. Contrary to the rest of the world, China has faced deflationary pressures, underscored by June’s negative core CPI. While deflation has presented a challenge for the world’s most populous country, it has benefited the rest of the world where inflation is still an obstacle.

Turning to the European Union, the economic landscape more closely resembles the US, albeit on slightly weaker footing. Harmonized CPI inflation has cooled from 8.5% in February to 5.5% in June as growth stalled. Though consumption and manufacturing have been contracting, we may be seeing early indications that the worst is behind us. If this is indeed the case, the EU will emerge from this slowdown without a substantial rise in unemployment, which could lead to a rapid recovery. A noteworthy risk remains the ongoing conflict in Ukraine, with the potential to cause supply shocks and exacerbate geopolitical tension.

Recoveries in other international economies have added to our cautious optimism. India’s growth has accelerated even while inflation has retreated. Similarly, we are seeing robust momentum in Mexico and much of Latin and South America, despite some political turbulence. Japan, too, presents an encouraging picture with a 17-month high in consumer confidence and a low unemployment rate of 2.6%.

Fixed Income and Higher Rates

The recent bond selloff has brought rates back near the highs set late last year. The 10-year Treasury yield approached 4.0% at the end of the quarter and briefly exceeded that in the early days of July. As investors’ appetite for risk assets like stocks grew, coupled with their acceptance of higher fed fund rates through 2024, perceived safe assets like treasuries were out of favor. As a result, new fixed income investments are providing the most attractive real yields in over a decade. The yield curve remains inverted which means both that there is still an expectation for recession in the near future and the best yields are in short maturity bonds. In this environment, it is worthwhile for balanced portfolios to consider whether bond investments can now be a greater part of their strategy but we continue to recommend that investments focus on high-quality and short duration selections.

2023 US Stock Markets: The Year of the Giant?

The answer to the common question, “how is the US stock market doing and what are its prospects for the rest of the year?” is never as straight forward as it seems. The US market includes a combination of benchmarks with divergent track records and future prospects. Consider the key US indices and their performance year-to-date through 5/31/23:

| US Stock Market Index | YTD Performance (5/31/23) |

| S&P 500 (market-cap-weighted) Index | +8.9% |

| S&P 500 (equal weight) Index | -0.6% |

| S&P MidCap 400 Index | -1.0% |

| S&P SmallCap 600 Index | -2.7% |

| Dow Jones Industrial Average | -0.7% |

| NASDAQ Composite | +23.9% |

| Russell 2000 Index | -0.7% |

| Source: FactSet |

This snapshot clearly illustrates a dichotomy: while one index has flourished, most have floundered. Notably, the technology-dominated NASDAQ Composite has rocketed +23.9%, which may seem surprising given its reputation as being highly sensitive to negative macro conditions. This prompts the question: why have these stocks soared amidst aggressive Federal Reserve interest rate hikes, rampant inflation, predictions of a US recession, banking industry turmoil, and a sluggish global economy? The data suggests that some investors, in their pursuit of relative performance, have needed to ignore these significant red flags. Consequently, risk-averse investors committed to a diversified portfolio are fighting an uphill battle in achieving competitive relative performance.

The pronounced disparity between the performance of the market-cap-weighted S&P 500 Index and its equal weight counterpart is primarily the consequence of the stellar performance of the largest companies – perhaps to an unprecedented degree. The six largest companies have been particularly impactful:

| Company | YTD Performance (5/31/23) | Market Capitalization ($B) |

| Alphabet | +38.7% | 1,563 |

| Amazon | +43.2% | 1,237 |

| Apple | +36.8% | 2,788 |

| Meta | +120.1% | 586 |

| Microsoft | +36.3% | 2,442 |

| NVIDIA | +159.1% | 935 |

| Source: FactSet |

These giant companies have an aggregate market cap of $9.4 trillion, which constitutes 25.8% of the S&P 500 market-cap weighted index. A mere 12% of S&P 500 stocks outperformed the index over the past 60 days, as of 5/26/23 (source: Schwab). Only three of the industry sectors (communication services +33.0%, technology +34.4%, and consumer discretion +18.9%) have posted positive returns year-to-date. This stands in sharp contrast with a -11.7% plunge in the energy sector and a -9.1% drop in the utilities sector, with the remaining five sectors in negative territory.

Why are these extraordinary trends happening and will they continue? While there is no definitive answer, a possible explanation is that many investors anticipate a robust recovery from the dire conditions of 2022 and are willing to overlook a possible recession in order to make sure they do not miss the new bull market when it comes. In addition, the mega-cap stocks mentioned above are benefiting hugely from the recent frenzy surrounding artificial intelligence. We are concerned, however, that this extremely narrow market leadership is not sustainable. This investor behavior is more akin to the mania seen at the end of bull markets, such as 2000, 2008, and 2021. In our estimation, a restored bull market will include broad participation, and thus we continue to recommend investors maintain diversified portfolios.

Economic and Financial Market Outlook Q2 2023

Summary

The rising risk of a US recession has diminished our cautious optimism for global equity markets, as stated in our January Outlook. The first quarter introduced new challenges to growth, including persistently high wage inflation, OPEC’s oil production cuts, and a banking crisis. These negative surprises are concerning and elevate the likelihood of a more severe downturn in the US. In fact, most countries are experiencing declining economic activity, though a soft landing is still possible. Investors with an elevated concern for preservation of capital may consider adopting defensive strategies until conditions improve.

Clouds over the US Economy

The US economy is mired in a difficult environment marked by slowing GDP growth, high inflation, and a Federal Reserve committed to raising interest rates further. The Economist April 8-14 consensus forecasts 2023 US GDP growth to slow to 0.8%, from 2.1% in 2022. The labor market remains a bright spot, with unemployment rates near all-time lows. This has sustained robust consumer spending, though consumers have progressively reduced their savings and relied more on credit for purchases. Though the strong labor market indicates that the US is not currently in a recession, it also has the effect of keeping wages stubbornly high. This creates sticky core inflation and puts pressure on the Federal Reserve to implement additional rate hikes, which impedes economic growth and can cause unintended consequences, like the banking crisis in the first quarter.

Bank Crisis Update

Almost a month has passed since a massive withdrawal of deposits at Silicon Valley Bank on March 9 led to its sudden collapse and triggered a bank crisis. Within a week, several other banks required a rescue. Fears spread that problems in the banking system were systemic and would endanger the entire global banking industry (see Marietta blog Bank Failures Increase Uncertainty 3/21/23). In recent weeks bank stocks have stabilized, although at a lower level, and fears of a prolonged crisis have subsided. The relative calm is due in part to autopsies of the failed banks, which indicates the bankruptcies were a consequence of mismanagement and not a systemic weakness. The stabilization was also in part a consequence of the rapid and effective action taken by the Fed and the Treasury Department.

At this point there is temptation to declare that the bank crisis is over. We think this view is premature, though the risk of a financial meltdown similar to 2008 is unlikely. The new emergency lending facility, the Bank Term Funding Program, is a very positive step forward, as is the government’s readiness to protect depositors. But there is still room for negative contagion to resurface, especially as the Fed funds rate goes even higher. One potential threat is that a huge flow of funds out of bank deposits into money market funds and US treasuries will diminish banks’ willingness and ability to loan, which will slow the economy. Worth noting is the April 4 warning by Jamie Dimon, chairman and CEO of JP Morgan, “the current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come.”

Resilient US Stock Markets

US stock market indices have been resilient, continuing to advance from October lows. However, S&P 500 earnings have fallen for two successive quarters, with projections for the first quarter indicating a third consecutive decline. As companies factor in the negative surprises from the first quarter, it is probable that management teams will issue further downward guidance. This combination of lower earnings expectations and higher stock prices has stretched valuations, pushing up the S&P 500 forward price-to-earnings ratio to 18.0x, above the 10-year average of 17.3x (FactSet Earnings Insight 4/6/23). As equities have gotten more “expensive,” yields on money markets and short-term bonds have risen to a level where they are a legitimate competitive investment. This is a relatively recent phenomenon; it has yet to be seen whether this will significantly impact the price investors are willing to pay for stocks, though the massive movement out of low yield money market funds indicates that investors are paying attention. Though the near-term outlook is muddled, we remain confident in our view that equities will provide investors with solid long-term returns. Investors should focus on adding exposure to quality companies with talented management teams, strong balance sheets, manageable debt levels, and growing market share. Special attention should be given to those companies benefiting from China’s reopening and a weakening dollar.

The International Opportunity

Despite strong growth in India and China, over 90% of international advanced economies are expected to endure declining growth in 2023 (International Monetary Fund, April 11 World Economic Outlook). We expect global growth to decline from 3.4% in 2022 to 2.8% in 2023, in-line with the IMF projection. Although this still constitutes a soft landing, there is a greater risk to the downside. The major negative developments causing this decline are high inflation, synchronized tightening monetary policy, the banking crisis, and the consequences of Russia’s War in Ukraine. A notable gap has opened between GDP growth expectations of 5.2% in China, and, in contrast, 1.6% in the US and 0.8% in the Euro Area. Much of this difference may be attributed to an estimated 2023 inflation rate of only 2.0% in China versus 4.5% in the US and 5.3% in the Euro Area.

We reiterate our view from our last Outlook that long-term investors consider adding more international stocks to their investment portfolios. The US dollar peaked in October and international stocks have rallied over +23% since, measured by the MSCI All-Country World ex-US Index (ACWX). The anticipated economic weakness in the US could push down the dollar further, continuing this trend. Despite this quiet rally, valuations remain compelling at 13.0x 2023 earnings. Developed international company earnings are expected to rise in the first half of 2023, in contrast to the US where they are expected to fall. Not all opportunities are created equal, and our focus is on high quality companies benefiting from long-term trends, including the burgeoning Chinese consumer, the proliferation of semiconductors, and resilient global household spending.

Bonds a Practical Alternative

As concerns for the economy have increased and the inflation rate has slowly come down, yields have reflected this by declining from March highs. In this period where there is a rising risk of recession, quality remains a prime consideration. We reiterate that short-term treasuries offer the best risk reward over money markets and longer-term bonds.

Bank Failures Increase Uncertainty

Summary

Events of the past week – high-profile collapses at Silicon Valley Bank and Signature Bank and rescues of First Republic Bank and Credit Suisse – have increased anxiety regarding the health of the global financial system. The situation is evolving rapidly and requires investors to remain well-informed and prepared to respond quickly. At this point, central banks and large global banks have intervened and seemingly put a stop to bank runs. That said, it is difficult to estimate the magnitude of the damage done and the potential for further fallout so investment outlooks must be updated to account for this increased uncertainty.

Marietta’s Response

Most importantly, Marietta clients did not own stock in the four failed banks. Nevertheless, we’ve tracked developments closely and taken steps to shield portfolios from possible contagion. We’ve reviewed all firm investments in bank securities, reduced exposure to money market funds that contain bank promissory notes, and increased holdings in US Treasuries.

A Broader Perspective

Banks can fail for a number of reasons, including mismanagement of funds and/or inadequate risk management practices, as was the case at Silicon Valley Bank and Credit Suisse. They are more common than one might expect. In the past decade, there have been 71 FDIC-insured bank failures. Of course, none were large enough to merit government intervention. In isolation, a bank failure is not a direct indicator of a broader economic slowdown. However, if it leads to significant collateral damage throughout the financial industry, a tightening of credit markets and declining consumer confidence could inhibit economic growth.

A Look Ahead

These developments have made our outlook more cautious but, for the moment, we do not anticipate a full-blown crisis as was the case in 2008-09. We will continue to monitor economic indicators and the broader market for signs of contagion and systemic risk and remain prepared to take further action if necessary. For now, we advise investors to stay focused on long-term objectives. We will provide additional commentary in our upcoming Economic and Financial Market Outlook.

Economic and Financial Market Outlook Q1 2023

Summary

Heading into the new year, almost all major economies are enduring broad-based challenges. The major issues that disrupted financial markets in 2022 are still apparent: high inflation, restrictive monetary policy, continuing COVID outbreaks, and an energy crisis brought on by the Russian invasion of Ukraine. After the declines of 2022, financial markets reflect the rising risks that have beset the global economy. In the US and the EU, central bankers seek to curtail high inflation without hammering their economies into a severe recession. In China, the focus is on reopening from years of zero-COVID policy shutdowns and implementing stimulus measures. While the present obstacles look daunting, if the major policy initiatives show signs of progress in the first half of 2023, then this could be the beginning of a multi-year advance in global stock markets, anticipating a global economic recovery in 2024.

US Economy

In the US, the Federal Reserve continues to aggressively raise interest rates and thus far has attained some success in lowering inflation. November core PCE, the Fed’s preferred inflation measure, retreated to 4.7% from 5.0% in October and 5.2% in September. We expect the Fed to stop rate hikes in the first quarter after an additional 0.50% or 0.75% increase. This restrictive stance will push inflation down over the course of the year at the expense of economic growth. There is already weakness in the housing, auto, and manufacturing markets. On the other hand, unemployment has stayed historically low, and the economy has added jobs for 24 consecutive months. We project 2023 US GDP to grow less than 1.0%, but not dip into a deep recession, though a short and shallow recession is possible.

US Stock Market

US equities look to bounce back from a dismal 2022. The major indexes fell into bear territory and while there was a slight recovery in the fourth quarter, the S&P 500 closed the year down 19.4% and the NASDAQ 100 was off 33.1%. Despite these numbers, there is reason for cautious optimism. Most of the factors that contributed to the selloff are moderating: inflation is slowing, the Fed is nearing the end of its rate hikes, and excessive earnings multiples have declined, though they remain near long-term averages. As we stated, we are expecting low growth, possibly even slightly negative growth, but an economy that bends without breaking should support modest advances in equities this year. Corporate earnings are expected to grow 5.3% this year which is a slight acceleration from 2022. The financial media seems to believe that these expectations will decline but that was also the case in 2021 when corporate earnings were resilient. Lastly, even though our optimism exists despite last year’s returns, there is a case to be made that one can be optimistic because of last year’s returns. Since World War II, there have only been three times when the S&P 500 had consecutive negative annual returns. Historically, after a decline of 20% or more in the S&P 500, the index has increased an average of 14%, 33.6%, and 61.5% over the following 1-year, 3-year, and 5-year periods, respectively. As long as the economy holds up, US equity investments will have a positive year in 2023.

International Economies

We are upbeat on international markets in 2023 as China ends their zero-COVID policy, EU inflation data eases, a mild winter calms fears of gas shortages, and global economic resilience surpasses last year’s grim expectations. The shift in China occurred late last year, when mass civilian protests led to a drastic policy change focused on growth. Since then, Chinese authorities have:

- Eliminated nearly all COVID restrictions

- Added 16 support measures for property sector, including a pledged $256B in available credit to bailout cash-strapped developers

- Cut the required reserve ratio 25 bps effective December 5, 2022 – with signals for more if needed

We think many economic forecasters underestimate the ability of the Chinese government to stimulate growth and, like other reopening countries, experience a swift rebound. If we are correct that China will grow above expectations, it will have a profound effect on the global economy, improving the prospects for many international economies and companies. The EU will welcome a boost to offset the restrictive monetary policy enacted by the European Central Bank. The ECB is raising rates to fight high inflation, though their tightening policy thus far has been modest compared to the Fed (2.0% benchmark rate vs 4.5%). Recent data suggests that inflation in the key economies of Germany, France, and Spain is moderating, giving the ECB the possibility to achieve their target inflation goals with less economic fallout. A major tailwind has been the precipitous fall in the price of natural gas, alleviating concerns of an expensive, and deadly, winter.

International Stock Markets

We recommend that long-term investors consider adding more international stocks to their investment portfolios. International stock market indexes trade at considerable valuation discounts to their US counterparts. On December 31, the MSCI All-Country World Index ex-US benchmark traded at a 11.8x forward P/E ratio, compared to the 18.8x forward P/E ratio of the S&P 500, a 37% discount. There are companies exhibiting strong balance sheets, talented management, and earnings growth that will benefit from improving economic trends both abroad and in the US.

Bond Markets

Recession concerns for the US and the EU drove a dramatic selloff in bonds pushing yields to levels not seen in a decade. Although the interest rates appear attractive, with inflation still above 5%, real yields on bonds are negative for most investment grade issues. Our recommendation remains to focus on short-dated bonds. Investors with a mandate for fixed income could consider medium-term bonds but should still overweight short issues to protect against losses if rates continue to rise. Quality should be favored as well, while below investment-grade presents unappealing risk versus return potential.

Has US Inflation Peaked?

2022: The Year of Inflation

As we approach the end of the year, undoubtedly the top story for the economy is inflation, with the increase in consumer prices reaching levels not seen since the 1970s. Consumers are feeling the pain as they try to manage budgets in the face of increased costs in all expense categories. A broader concern is that the high prices will lead to reduced consumption, raising the risk of recession. How much longer will we contend with high inflation? First, this environment has no historical precedent to make comparison with so there will be considerable uncertainty. Second, assessing inflation can be uniquely challenging because of how personally the effects are felt. Therefore, we emphasize taking special care to rely on a wide range of data to support our forecast and maintain caution against negative surprises. Ultimately, our view is that inflation in the US has peaked and is starting a downward trend which will continue throughout 2023, falling below 4.0% by the end of next year.

Where is Inflation Now?

We think that it is more likely inflation is falling based on the most recent batch of data and Federal Reserve statements. October was the first evidence of Fed policy leading to lower inflation, with broad-based core goods prices declining. Headline CPI came in at 7.7% year-over-year, down from 8.2% in September and the 9.1% high point reached in June. Core CPI fell to 6.3% from 6.6% in September. Key housing readings (primary rents and owners’ equivalent rents) experienced a steep drop off, among the largest since the early 1990’s. Goods prices saw their prices fall month to month across the board, including furniture, apparel, medical services, used and rental cars, and electronics. To be sure, these CPI readings are far too high and decelerating price increases is not the same as prices coming down. It will be a long time until there is relief for the consumer in the form of lower interest rates or an increase in real wages (inflation-adjusted compensation).

Can this trend continue?

We have confidence in this peak-inflation view because many of the inflationary pressures of 2021-22 have abated and tighter monetary policy is in place to restrain price growth:

- The Federal Reserve is determined to reduce inflation as its central objective. The impact of rate hikes is limiting corporate and consumer borrowing, especially with small businesses and the housing market. Chair Powell has clearly stated that he does not fear tipping the US economy into recession and that there is greater risk in lowering interest rates prematurely than raising them too high.

- The unprecedented monetary and fiscal stimulus from the pandemic is over, which will curb consumer spending and bank lending. With a divided Congress in place for the next two years, we see little prospect for additional stimulus.

- Supply chain issues that limited the availability of all manner of goods are rapidly receding. Container ships are no longer waiting for days at ports and trans-Pacific shipping costs indicate that capacity is back to normal.

- While the labor market has yet to react to a slowing economy, several large companies have recently announced layoffs and hiring freezes. This is expected to continue and show up in the data soon, with unemployment rising throughout 2023. While we do not want to minimize the hardship of job loss, we recognize if this occurs the weaker labor market will further reduce inflation.

What are the major threats to our forecast?

While we predict inflation will continue to trend lower, it is unlikely to be a smooth transition to a low-inflation environment. Several key obstacles remain and could quickly change the outlook:

- There is still a global energy crisis, with the Russian-Ukraine war and the corresponding sanctions disrupting oil and gas supply worldwide. Another supply shock, similar to the one earlier this year, would be problematic.

- Geopolitical tensions remain elevated, which leads to reshoring and anti-globalization efforts, thereby raising the cost of goods.

- Long-term inflation expectations remain above target. Key to returning to the Fed’s 2.0% inflation goal is consumers believing that they will succeed.

The focus on inflation will continue into 2023. As stated above, it will take time to return to normal and we will monitor developments closely to ensure the improvements stay on track. We welcome your thoughts and wish you and your families a safe and happy Thanksgiving.