The past two Marietta quarterly Outlooks presented a positive case for equity markets in 2017. From the Q1 Outlook: “We expect the S&P 500 Index will mount a 10-12% advance in 2017, which will reflect a U.S. GDP rise from an estimated 1.6% in 2016 to 2.5% in 2017 and a low double-digit spurt in corporate profits.” From the Q2 Outlook: “Our economic growth projections should translate into corporate profit gains for the year of 10-12%, which should diminish valuation concerns. Positive tax reform and deregulation could provide an additional boost.”

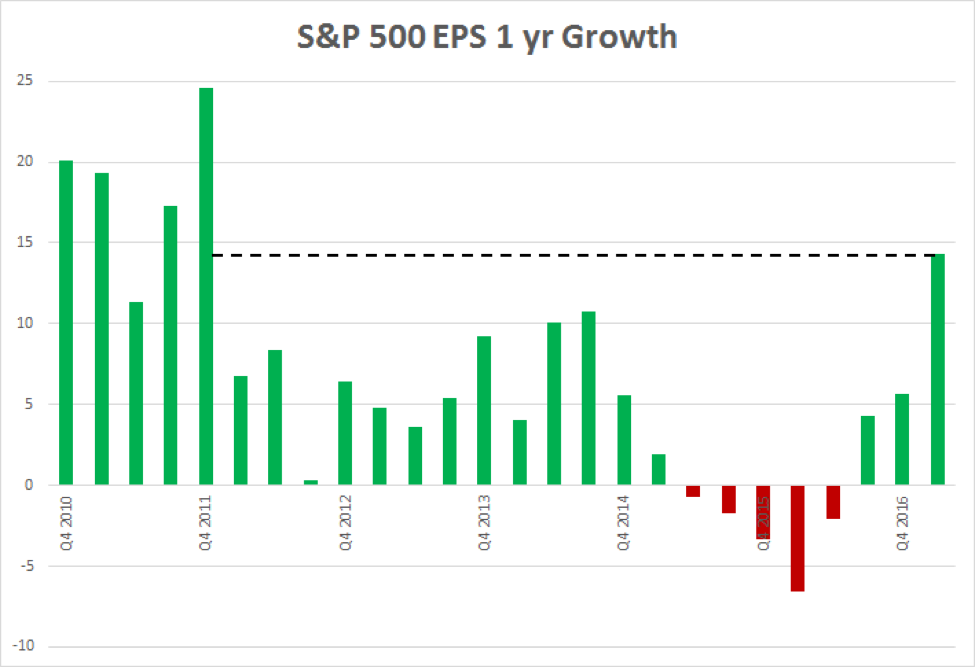

Our optimism is anchored in the theory that stronger global growth will push corporate profits higher. We are encouraged that, in spite of disappointing first quarter GDP growth in the US (0.7%), corporate profits surged. According to FactSet’s Earnings Insight, as of Friday, May 5, 83% of S&P 500 companies had reported results for the first quarter of 2017. Of those companies, 75% beat on estimates for earnings per share and 66% beat on estimates for sales. These numbers suggest an earnings growth rate for the aggregate S&P 500 of 14.8%, which would be the strongest performance since the fourth quarter of 2011.

These results support Marietta’s projection for full-year S&P 500 earnings growth of 10-12% but the year is far from over. The question now is: are they sustainable? Significant contributions from both the energy and materials sectors came in part from lapping year-over-year lows in commodity prices. The tailwind is thus a one-off to earnings for the first quarter and will not benefit subsequent reports. Still, companies in these sectors have come a long way since the collapse in commodities in early 2016 and a rebound in their performance is clearly a positive. On the other hand, more durable earnings can be expected from the financial sector, which experienced +20% growth in the first quarter. This, in part, is attributable to higher interest rates, which we believe will continue to rise throughout 2017. Moreover, profit growth for the index was broad-based; the only decline in sector earnings and revenue came from telecommunications companies.

The 14.8% growth in first quarter profits coincided with a rise in the S&P 500 Index of 6.1%. We acknowledge that valuations are above historical averages but, if profits rise, stock markets should rise by at least an equal amount. We therefore reiterate our forecast for 2017 profit growth of 10-12% and look forward to further stock market gains.