Economic And Financial Market Outlook Q1 2019

Despite heightened year-end volatility, we confirm our cautiously optimistic outlook summarized in our December 7 blog:

- The US economy will slow from its approximate 3.0% growth in 2018 to 2.0%-2.5% this year and corporate profit growth will decelerate from its 20% plus pace to about 7%-9% in 2019.

- The major threats to this “soft-landing” remain an international trade war and a policy mistake by the Federal Reserve. We place a relatively low 10% probability on the US falling into recession.

- We think the S&P 500 Index was oversold at year-end and will recover from its -4.4% performance in 2018 to return at least 9.0% this year.

- International economies will also moderate, though global GDP growth is expected to slow from about 3.7% to a still satisfactory 3.4% this year.

- International equity markets provide even more attractive valuations than the discounted US market. Significant opportunities exist for long-term investors in emerging markets if, as we expect, China maintains healthy growth and a global recession is avoided.

The US economy, unlike the stock market, enters the year with considerable strength. The unemployment rate is at a 49-year low, consumer confidence is near 20-year highs, wage growth is rising at the fastest pace since 2009, manufacturing and confidence surveys are robust, and inflation is anchored near 2%. Some of the recent boost can be attributed to one-time benefits from tax reform, so we expect 2019 growth to ease toward longer-term trends. However, it would take a meaningful shock to overthrow this considerable momentum and create a recession. Such disruptions potentially could arise from all-out trade wars or major policy errors from the Fed. We are encouraged by recent developments on both fronts, but we are not yet out of the woods. The Fed has indicated that it will make decisions based on incoming economic data and has decreased its projected 2019 rate hikes from four to a maximum of two. As for the US and China’s trade confrontation, significant progress has already been made; additional tariffs have been put on hold and negotiations have resumed. Pressure has increased on both sides to resolve the conflict as the trade war has begun to negatively impact economic growth. We think each side understands that both countries will lose if an escalation occurs.

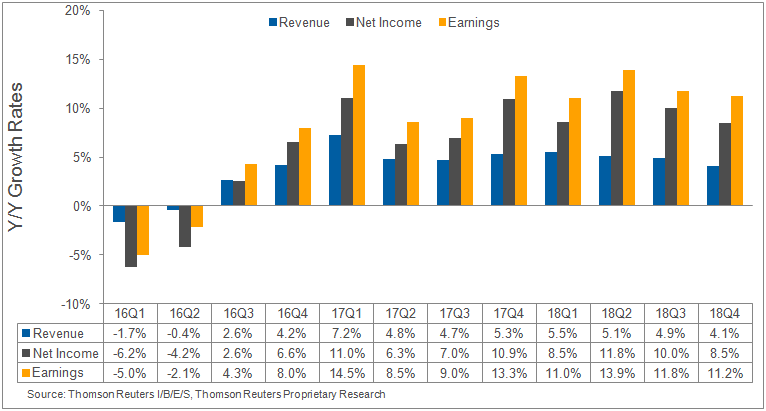

In stark contrast to the booming US economy, the US stock market had its worst year since 2008 and suffered three falls of 10% or more throughout the year, two of which were in the fourth quarter alone. The stock market weakness occurred despite corporate profits rising over 20% in 2018. The impact of this earnings divergence on today’s market is that the S&P 500 Index price earnings ratio (P/E) of 14.1x is below both the five and ten-year average of 16.4x and 14.6x. With a cheaper than average market valuation and expectations for solid 7-9% corporate profit growth this year, stocks look attractive. A significant advance, however, will require investor sentiment to shift.

It is also useful to place the current market downturn in perspective. From its peak last September 20, the S&P 500 Index fell just under 20%, the traditional definition of a bear market, by Dec. 24. Since 1980, there have been 12 occurrences when the S&P 500 Index declined between 10% and 20% and on average it has taken less than four months to recover the previous highs. If the market were to drop further and enter a bear market, long-term investors should take note that from 1900-2018 there have been 32 bear markets, or about one every 3.5 years, and they have lasted an average of 367 days. Additionally, multi-year bull markets typically follow bear markets, with the strongest gains in the first year of recovery. In the year following the last three 20% declines, the S&P 500 Index gained an average of 32.5%.

We expect global GDP to slow in 2019 from 3.7% to 3.4%. A significant portion of this decline may be attributed to a deceleration in the US, which accounted for approximately 24% of global GDP in 2017, and to China, which accounted for 15% (source: IMF). Their combined importance to global economic stability is manifest, and our growth estimate assumes that both the US and China avoid recession in 2019. We also expect growth to slow but avoid recession in the leading advanced economies, including the euro area and Japan. These slowdowns will be offset by a pickup in several key emerging economies.

There is currently as much controversy regarding the future strength of the Chinese economy as there is the US economy. We predict a modest GDP growth decline from 6.5%-7.0% to 6.0%-6.5%. Our view is that the ability and the determination of the Chinese government to maintain at least this level of growth is underestimated by many economists who consider a plunge to be inevitable. To respond to their slowing economy Chinese policy makers are reducing taxes, easing banking restrictions, accelerating infrastructure spending, and lowering the reserve requirement ratio. We also think that they will respond to acute pressures and reach a favorable agreement with the US on trade policy and intellectual property concerns. If a trade peace occurs in congruence with the monetary and fiscal stimulus measures, investment in many of the stocks of Chinese companies and companies that do business in China, which have been severely damaged, could be rewarding.

A case can be made for emerging market stocks based on valuation and sentiment. 2018 marked another year of disappointing market returns for emerging market companies, and over the past five years, as measured by the iShares MSCI Emerging Market ETF (EEM), they have returned a paltry 7.7% versus a gain of over 50% in the S&P 500 Index. Their 11.7x P/E has declined to a level that is extremely attractive compared to other global markets. Emerging market corporate profits are expected to be high-single digits in 2019 amidst steady economic growth in major economies. We think many patient long-term investors will conclude that the multi-year trend of emerging market underperformance has ended, and investments in these companies may prove to be very timely. Worth noting here is that the EEM fell only about half the S&P 500 Index in the 4thquarter 2018, even though emerging market stocks are often considered to be higher risk. A trend reversal may already be underway. Stability in China is paramount to the case for emerging market stocks, as China consumes about 50% of global commodities. Another key consideration are the pro-growth policies of governments and central banks, and we think Brazil and India offer prime candidates for investors.

We agree with the IMF that none of the major advanced countries in Europe and Asia present significant growth prospects. Further, the euro area lacks cohesive leadership and there will be ongoing “Brexit” headaches, Italian debt issues, and the threat of political instability in France and Germany. We think this will depress economic output and investor sentiment. Without additional stimulus measures, the equity markets of non-US developed countries are unexciting but individual company fundamentals should still be considered. Our bottom up approach in this area tends to focus on consumer discretion, health care, and technology companies.

Medium and long-term bond yields fell from recent highs in the fourth quarter as investors sought safety amid a volatile stock market. We expect bond yields to remain range-bound in 2019, with 10-year Treasury yields fluctuating between 2.5%-3.0%. Bonds that are investment-grade, high-quality, and relatively short in duration should continue to provide portfolios with capital preservation and a modest income stream. However, not all bonds are created equal. We do not recommend increasing risk to get higher yields by investing in low-quality junk or longer duration bonds. Investors wanting to take on more risk should do so in the stock market.

Economic And Financial Market Outlook 4Q 2018

- The three- to six-month outlook for stock markets is generally favorable.

- Forecasting beyond six months is more challenging than in the past due to greater uncertainty regarding growth, trade, inflation, and fiscal and monetary policy.

- Given the cloudier medium-term view, investors should review asset allocations and confirm their portfolio strategy.

The decade-long global expansion has continued into this year’s second half, led by a robust US economy. While aggregate growth has increased, it has been more uneven than the broad-based acceleration last year. Several key economies slowed from their 2017 pace, notably the Eurozone, Japan, and the UK. Looking ahead, we agree with the IMF’s projection for global GDP to rise 3.9% in 2018 and another 3.9% in 2019. The challenging stock market conditions of the first half of the year began to abate in the third quarter as many of the major fears of investors subsided: inflation did not spike, global growth did not weaken, and the US dollar paused from its rapid rise. The US stock market responded especially positively, backed by corporate profits in excess of 20% through the year’s first six months, over $1 trillion in scheduled buybacks and dividends, and still limited competition from bonds and money market funds. However, the global trade situation deteriorated more than expected, which continued to put pressure on international equities and elevate uncertainty. In the short-term, we think that global stock markets should trend higher, reflecting healthy fundamental financial conditions. On the other hand, the road ahead will include increased volatility as risks of policy errors rise.

The US economy has been outstanding, with quarterly real GDP growth of over 4% for the first time since 2014. Employment data continues to be very strong, small business and consumer confidence readings are at or near multi-year highs, and manufacturing surveys show a sustained expansion. Consumers, invigorated by lower tax rates and favorable employment prospects, are spending at a rapid clip with retail sales +5.2% so far this year. Despite this auspicious backdrop, an increasing number of CEO’s and managers are cautious about next year, citing trade tensions and labor shortages. Tariffs have the same effect as increasing taxes on US companies and this extra cost pressures profits. Finally, we are watching closely the housing market, which has seen a year-over-year decline in existing-home sales and new home construction, and a pickup in foreclosures. We do not consider this to be a red flag at current levels as this hiccup is far from the extreme depths of past crises, but a continued slowdown will be a drag on the otherwise stalwart economy. We reiterate our expectation for the US economy to continue its above-trend growth in 2018 with a more moderate increase in 2019.

The major US indices fully recovered from the market correction in early 2018 and set new all-time highs in the third quarter. We think the US market remains promising in the short-term, bolstered by a strong economy, rising corporate profits, and record stock buybacks and dividends. S&P 500 company earnings soared over 20% in the first two quarters of 2018, and analysts project a 19.3% and 17.2% rise in the third and fourth quarters respectively. Initial estimates for 2019 are also propitious, with a further 10.3% rise expected. Though stock market indices have risen, equities have not kept pace with the surge in company earnings. This development results in lower, more attractive, valuations than this time last year. With record levels of stock buybacks providing a steady stream of buying activity and the relative unattractiveness of bonds and money markets, near-term fundamentals are compelling. However, the recent recovery in the market hasn’t been as strong as it appears on the surface. Small cap stocks fell -3.2% in September, and a majority of the positive S&P 500 gain so far this year has been concentrated in just a select few mega-cap companies. A healthy market includes broad-based participation. We will be monitoring this developing scenario carefully. A further narrowing in the stock market would warrant more caution.

A refrain echoed by many investors and the financial media is that the bull market has gone on so long that it must end soon. We reject the notion that a bull market can end simply from old age. Instead, there needs to be a catalyst that brings on a sustained and substantially negative stock market. Often, that trigger is a recession. There are two prevailing narratives that the Marietta investment team considers most likely to cause the next bear market. First is that the US economy will heat up too much too fast. If US real GDP continues to rise 4% per quarter, the growth probably will be accompanied by higher wages and inflation. In response, the Federal Reserve may ratchet up interest rates faster than the market expects and slow down the economy, ultimately causing a recession. The second scenario is that the boost from tax cuts will be ephemeral, growth will slow to a crawl, the huge budget deficit will cause borrowing costs to rise, and the next recession will be ushered in with fiscal austerity and trade wars. To be sure, we do not think that either of these scenarios will come to fruition in the next 3-6 months. However, we are scrutinizing data daily to see how the economic and financial picture changes.

In contrast to US equities, most international stock markets did not rebound in the third quarter with the MSCI All-country World Index (ACWX) providing a paltry 0.9% total return, still down 9.9% from the January highs and -3.1% year-to-date. Advanced economies have produced a lower GDP output than expected in 2018 but are still showing improved incremental growth. Emerging economies have enjoyed stronger growth from oil exporters as the price of oil has risen but complications with the strong dollar have caused some financial stress in countries with high debt levels. Tax relief has not benefited overseas corporations, so their steady 5%-8% projected profit growth pales in comparison to their US counterparts. The use of tariffs as a tool to gain trade concessions has also soured investor sentiment toward international investing, exacerbated by the escalating tensions between the US and China.

The underlying economic situation in international economies is not, in fact, bad. Inflation is low and stable in key countries and purchasing manager index data supports further expansion. International equities offer a significant discount to stocks in the US, and in many cases, even more so now than at the beginning of the year. The fundamental backdrop for international stock markets would be attractive in isolation. However, they have been buffeted by macroeconomic obstacles while the US stock market has been insulated from the negative sentiment thus far. This prevents us from having a more optimistic outlook for international equities. Currency stabilization and proactive budgetary reforms in certain countries would be a good step forward, but for the lid to lift off international equities we think that a resolution to the trade war with China is required. If this occurs, we think investors will witness a swift and significant rise in international stock markets.

Bond yields have moved steadily higher, with benchmark 10-year US treasuries reaching levels not seen since 2011. The upward swing in yields corresponds with the Federal Reserve raising short-term interest rates an additional 25 basis points each quarter thus far in 2018. The result has been that longer-term bonds have provided negative year-to-date returns, while those with shorter duration have outperformed. For example, the Bloomberg Barclays US Aggregate 1-5-year bond index was nearly flat with a -0.1% return, while the Bloomberg Barclays US Aggregate Credit 5-10-year index declined -2.0%. We expect this trend to endure in the short-term and continue to recommend buying high quality and maturities of five years or less. We think that patient investors will be able to purchase bonds with higher yields at year-end.

Economic And Financial Market Outlook 2018 Q3

The case for a continuation of the 2017 synchronized global economic acceleration, which proved so beneficial to the worlds stock markets last year, has faded modestly. Whereas global GDP growth jumped from 3.2% in 2016 to a healthy 3.8% in 2017, we now expect a modest increase to 3.9% in 2018. As in 2017, all the world’s largest economies are expected to contribute to this growth. The brightest spot in this forecast is the surging US economy, which will likely enjoy its strongest year since 2005 and produce corporate profits in excess of 20%. Normally such strong fundamentals here and abroad would result in improved equity markets. Since late January, however, the elevated risk of trade wars has overshadowed macroeconomic positives and resulted in disappointing returns:

| Year-to-date Market Returns | |

|---|---|

| S&P 500 | 2.7% |

| Dow Jones Industrial Average | -1.8% |

| iShares MSCI EAFE ETF (EFA) | -2.8% |

| iShares MSCI Emerging Market ETF (EEM) | -7.4% |

We anticipate volatility will remain elevated and at times unnerving, but by the end of the year favorable stock market conditions, including strong earnings, record buybacks, improved valuation, and lack of competition from bonds and money market funds, will drive stock values higher.

The US economy gained momentum in the second quarter and remains on track for a second consecutive year of accelerating growth. Retail sales are robust, up 5.2% thus far in 2018 and surging 5.9% in May. The labor market is hot, with headline unemployment below 4%. Manufacturing readings indicate high levels of activity. While current data have been substantially positive, this was widely expected following stimulative tax cuts and strong global demand. Now the key question is: will higher growth rates persist beyond 2018? In June, the World Bank predicted that US GDP growth will slow from 2.9% in 2018 to 2.5% in 2019, and return to the 2.0% level in 2020 (Global Economic Prospects: The Turning of the Tide? 2018. Washington, DC. World Bank Group). While our forecast is slightly higher than the World Bank, we think a slowdown in future years is likely as the sugar rush of fiscal stimulus wears off and protectionist trade policies slow economic activity. Already we are hearing cautious comments from management in a multitude of industries that include slowing new orders and rising costs due to tariffs. Though the expansion may be peaking, we forecast a measured multiyear deceleration to GDP growth more in-line with the average 2.1% from 2011-2017.

Investors need not worry though, as a decelerating economy has accompanied a rising US stock market in the past. Since the 2001 recession, growth slowed in 6 of the 16 subsequent years absent a recession. In each of those years, the S&P 500 total return was positive with an average return of 12.1% and a median return of 8.8%. We think that US equity markets will continue to trend higher if, as we forecast, corporate profits continue to rise, inflation stays relatively low and stable, and the Federal Reserve does not dampen growth by raising interest rates too quickly. Following 20% plus profit gains in 2018, we project a solid 10% increase in 2019. The outlook for inflation is more complicated. Longer-term deflationary pressures persist, including aging demographics, low productivity, and increased pricing competition. On the other hand, steel and aluminum tariffs are already pressuring prices higher with additional tariffs in the pipeline. A further concern is the tight labor market producing higher wage costs. Though recent developments have pushed inflation through 2.0%, we think it will gradually rise to around 2.5% but not spike to an alarming level. This will allow the Fed to continue its measured pace of interest rate hikes with an eye toward normalizing rates rather than slowing down an economy that is running too hot.

On the international front, macroeconomic conditions remain supportive of a further advance in most equity markets, although growth is moderating from very favorable conditions in 2017 and risks are mounting. Last year, both advanced and emerging economies benefited from:

- Persistently low inflation resulting in continued monetary policy accommodation

- Strong growth in Asia, led by China and India

- Surging corporate profits above 20%

- Improved commodity prices, benefiting many export-oriented countries

- A weaker US dollar, especially supportive for emerging markets

- A notable rebound in global trade

Momentum carried into 2018, but fears of trade wars and the negative impact of a strong dollar upset investors and brought about stock market declines. The recent pullback is not reflective of positive economic fundamentals. The euro area is slowing but to a sustainable rate. Purchasing manager index data are still expanding, a weaker Euro should fuel exports, and core inflation remains below the ECB target, which has resulted in more accommodative monetary policy than expected. While we forecast the US and EU to slow modestly in 2019, the driver of the global expansion will continue to be emerging markets, which in aggregate account for almost 60% of world GDP and over 70% of global growth. Our outlook remains that international company profits, led by those domiciled in emerging countries, will grow double digits this year and next and lift stock prices.

In our view, a further escalation of trade wars and a continued rise in the dollar are the major threats to global prosperity and rising stock markets. We think the imposition of tariffs are an economically and geopolitically destructive strategy to gain trade concessions. Additional restrictive policies would likely end the rebound in global trade and reduce global GDP growth. Fearing this, investors have fled to the safe-haven US dollar and called into question the debt levels of certain countries, including China. If trade hostilities recede, we would anticipate a huge and swift positive impact on international markets, which currently have very attractive valuations.

The US bond market has undergone a significant shift this year. Bond yields have risen substantially since the end of 2017, driven up by interest rate hikes from the Fed and stronger economic growth. The result is that most bond funds have a negative year-to-date return and bond values have fallen. However, investors who hold bonds to maturity will still receive net gains in combined income and principal. Of note, short-term bond yields have risen faster than long-term yields. In the past an “inverted yield curve” has been an indicator of recessions; this occurs when the yield on two-year treasuries rise above ten-year treasuries. We do not forecast an inverted yield curve this year but we will closely monitor the developing situation. We continue to recommend holding high quality, short- to medium-term bonds to maturity to limit downside risks to rising rates.

Economic And Financial Market Outlook 2018 Q2

Throughout 2017 and entering 2018, global equity markets moved steadily higher with historically low volatility. Supporting the optimism were the favorable conditions of improving economic growth and soaring corporate profits in combination with low inflation, low interest rates, and accommodative central bank policies. In early February, new threats to this auspicious backdrop emerged. By February 8, the S&P 500 Index plunged 10% from its late-January highs, the first decline of this magnitude since February 2016, and volatility persisted for the rest of the quarter. Two fears dampened investor enthusiasm. First was that in the U.S., a tight labor market and increased economic demand would trigger wage inflation, which in turn would lead to rising bond yields, below-expectation corporate profits, and above-expectation interest rate increases by the Federal Reserve. Second was that newly proposed tariffs would escalate into stagflation-inducing trade wars and possible recession. In our last Outlook, we identified an inflation spike and trade wars as potential, but improbable, hazards. Clearly the risks of both have become elevated and some caution is warranted. At this point, we think these anxieties will dissipate. We continue to expect the global economy and corporate earnings to remain robust, equities to recover, and bond yields to rise steadily as the year progresses.

The U.S. economy is on its strongest footing in a decade. We agree with the consensus view that 2018 will mark a second consecutive year of accelerating GDP growth and we reiterate our forecast for a healthy 3% increase. First quarter data showed broad-based positive readings pertaining to the labor market, consumer confidence, and business confidence and investment. Housing is still a positive, though increased supply would help to put more families into homes. Corporate profits are poised to benefit enormously from increased economic activity and lower taxes. FactSet indicates that analyst’s first quarter earnings estimates have increased dramatically for companies in the S&P 500 and that full year expectations have increased too, from 11.4% to 18.5%. The upward revisions to estimates were record-highs, with a record-high number of companies issuing positive guidance in the last reporting quarter. To be sure, these projections do not factor in an aggressively hawkish Fed or fallout from trade wars.

In early February, the market responded very negatively to a strong employment report that included a surprising rise in wage growth, a leading indicator of inflation. We think price indicators should be tracked closely, but at this point do not see convincing evidence that there will be an imminent inflation upsurge sufficient to disrupt consumption behavior or bank lending. The latest reading of the core PCE index, often thought of as the preferred measure, was a below-target 1.6% change from a year ago. We agree with the consensus projection that inflation will modestly rise to near 2% this year, which should not provoke the Fed to increase the magnitude or speed of future rate hikes. The benchmark interest rate has been raised five times in the past 15 months without upsetting investors or damaging the economy. We expect the Fed to continue its measured and non-threatening approach.

Investors are understandably terrified of the prospects of a trade war, especially one that includes policies targeting China. We consider it unlikely that the executive branch would participate in a trade war, which would almost certainly induce stagflation, depress the stock market, and damage its party’s November election prospects. Rather, it seems to us that President Trump’s negotiating tactic is to come out strong at first but subsequently accept a more modest agreement. The new South Korea trade deal shows that the administration is more interested in getting positive outcomes than vindictively punishing partners. We think this will also be the case with NAFTA and China. Moreover, Chinese cooperation is paramount in working out a solution with North Korea. Nevertheless, negotiating protectionist tariffs can easily get out of hand, especially in countries where nationalism influences government policies. We will continue to monitor the situation carefully.

We highlighted the year-end accelerating strength of the global economy in our January 8 Outlook, and projected the world’s GDP growth to rise from 3.7% in 2017 to 4.0% in 2018. The International Monetary Fund on January 11 issued a similar optimistic forecast:

The cyclical upswing underway since mid-2016 has continued to strengthen. Some 120 countries, accounting for three quarters of the world GDP, have seen a pickup in growth in year-on-year terms in 2017, the broadest synchronized global growth upsurge since 2010…Purchasing managers’ indices indicate firm manufacturing ahead, consistent with strong consumer confidence pointing to healthy final demand.

Our forecast for advanced economies, which include Europe, UK, Canada, Japan, and Australia, has been revised upward to above 2% in both 2018 and 2019. The major contribution to global growth, however, will come from emerging economies with increases of about 5% in each of the next two years. Leading the way will be developing Asia, which is expected to expand at a 6.5% clip and account for over half of world growth. The economic recovery in Latin America is also expected to strengthen, especially in Mexico and Brazil, to above 2% in 2018 and 2019. Emphasizing the synchronized extent of the expansion, the IMF also anticipates a pick-up in emerging Europe, the Middle East, and Africa.

International financial markets have been and will likely continue to be very sensitive to headline inflation and tariff developments in the U.S. If our forecast that U.S. inflation and trade-war fears will gradually decline without disrupting growth and profits is correct, then very positive fundamental international economic conditions will likely trigger international as well as U.S. stock market rallies. As was the case in 2017 and early 2018, investors are expected to go where growth is greatest. The major beneficiaries will likely be growth-oriented companies in emerging countries. Also attractive will be multinational corporations with heavy sales into emerging economies. One possible risk to this favorable forecast is a significant slowdown in China. Another concern is the possibility that central banks will change their accommodative policies. As noted above, we think the greatest threat to international equities is a global trade war which will prove especially damaging to export-oriented emerging economies and companies.

Bond yields are likely to rise slowly, reflecting stronger global GDP growth and a slow winding down of central banks’ balance sheets. Yields are unlikely to spike higher, however, due to low interest rates abroad and low inflation. Investors should consider short to medium term, high quality bonds in order to decrease portfolio volatility.

Economic And Financial Market Outlook 2018 Q1

We expect the economic and equity market backdrop of 2017, which propelled global stock returns higher, to extend into 2018. Last year, for the first time this decade, a synchronized global economic acceleration accompanied supportive policies by leading central banks, surging corporate profits, and moderate, non-threatening inflation. This year, we forecast global GDP to rise from 3.6% in 2017 to about 4.0%, which will fuel double-digit corporate profit and stock market gains in key countries. In the U.S., there will be a further boost to earnings as the new tax law takes effect. We also enter the year with very high business, investor, and consumer optimism around the world. However, this sentiment is reflected in current stock prices and thus we expect equity returns in 2018 to be more in line with historical averages. These positive trends should encourage investors who question how much further stocks can rise. Despite our favorable assessment, we caution investors against complacency. A significant slowdown in Chinese economic growth, rapidly rising inflation, or the possibility of policy error by governments or central banks could have a negative impact on equity markets and disturb an otherwise upbeat outlook.

The economic expansion in the U.S. that began in 2009 continues unabated. Despite damage and disruption from several natural disasters, GDP rose over 3% in the second and third quarters of 2017. Fourth quarter data again exhibited broad-based economic health and revealed positive surprises: holiday retail sales grew 4.9%, consumer and business confidence remained near multi-year highs, the housing market steadily improved, manufacturing accelerated, and the unemployment rate reached new lows. Growth abroad and a declining U.S. dollar aided the economy considerably. We expect this momentum to lead to another year of accelerating U.S. GDP growth around 3%. Meanwhile, despite this strength, inflation has only risen slightly with core inflation still below the Federal Reserve’s 2% target. The improving economy in combination with low and stable inflation has allowed the Fed to raise rates at a modest pace without upsetting the stock market. We think this dynamic will continue in 2018.

Given the economic climate, our outlook for U.S. stock markets is positive, as it was in 2017. We acknowledge that equity valuations are above historical averages, but we are not yet alarmed considering the numerous other favorable factors. Rather, we think that a low double-digit rise in corporate profits (excluding the benefits of tax reform) should justify a corresponding advance in stocks without stretching valuations further.

As for international economies and stock markets, we also predict a continuation of salient 2017 trends. Critically, the synchronized economic acceleration, which started in 2016 and gained momentum in 2017, will strengthen in 2018 with GDP rising to 4% or even higher. This will mark the strongest annual global growth since 2010, and should elevate profits of international companies above 10%. Modest inflation, low interest rates, and supportive central banks should also contribute to our forecast of a double-digit advance in global stock market benchmarks. The strength of the global economy coupled with a mild inflationary environment will allow commodities to hold their recent gains but should not lead to a concerning surge in prices.

Developed country economies are healthy. We forecast euro area GDP to rise above 2% in 2018 driven by revived bank lending, increased consumption, declines in unemployment, strong business confidence, and record manufacturing productivity. Japan’s economy should continue to improve led by capital investment, personal spending, and strong exports. The UK, however, will remain relatively weak versus other developed countries as uncertainty over the outcome of Brexit negotiations will likely reduce investment spending and precede a rise in import prices.

We think emerging market countries are in the middle of a multi-year economic acceleration. The International Monetary Fund shares this outlook: it forecasts aggregate emerging market GDP growth to rise from 4.6% in 2017 to 4.9% in 2018 and above 5.0% in 2019. Southeast Asia is projected to reach an average growth rate above 6%. India will benefit from monetary, banking, and tax reforms introduced in 2016 and 2017; we see growth of 7.5% this year. The Chinese economy may slow slightly from an estimated 6.8% in 2017 to about 6.5% in 2018, but we do not consider this modest decline to be alarming. More important than the growth rate is the success of the Chinese government’s effort to shift economic growth away from investments and exports to consumption. We will closely monitor consumer spending, which we expect will again rise at a double-digit rate. Finally, most of Latin America should contribute to this emerging market trend, but Brazil is struggling to achieve its potential.

We have noted in past Outlooks a correlation between global economic growth and the world’s stock markets over the past 15 years. In years of significant GDP acceleration, international equity markets increased in value, with emerging country markets rising more than developed country markets, including the S&P 500 Index. This occurred in 2017; the iShares MSCI Emerging Markets ETF (EEM) was up 37.3%, the iShares MSCI EAFE ETF (EFA) gained 25.1% and the S&P 500 Index rose 21.8%. While the gains for international stocks in 2017 were impressive, they followed years of substandard performance and valuations remain attractive. With 2018 GDP growth in emerging countries anticipated to be approximately 2.5x that of developed markets, one can envision this pattern playing out again. As was the case last year, we expect investors to go where the growth is strongest, especially if there is a continuation of last year’s dollar decline. In particular, in emerging markets we favor stocks of consumer-oriented, technology, and financial companies.

To be certain, this is not to say that equity investments are devoid of risks in the coming year. We are most concerned about the possibility of a rapid rise in U.S. inflation that would force the Fed to tighten monetary policy faster than projected. If this were to occur, a misstep by the Fed (which will have new leadership and likely a number of key vacant posts) could slow economic growth. Similarly, healthy growth in China cannot be taken for granted. Some economists have drawn attention to excessive Chinese debt, which could erode growth and possibly lead to a global recession. Lastly, we are mindful of increasing focus on economic protectionism and hostility towards global trade, which would most negatively impact U.S. multinational corporations. While we remain vigilant, we do not expect these threats to materialize in the short-term.

On the other hand, we are more concerned about risks to the U.S. bond market than to the equity market. If the U.S. economy grows and the Fed raises rates, higher yields will likely result in low or negative bond total returns. Most vulnerable are long duration bonds and bond funds. This is not to say that fixed income investments do not have a place in some portfolios. They remain useful for preserving capital and producing less volatile returns in the event of a surprising economic downturn. We recommend that risk sensitive portfolios continue to hold high quality bonds with short maturities.

Economic And Financial Market Outlook 2017 Q4

The Marietta Investment Team projects that the current attractive economic and financial market environment will continue through the end of the 4th quarter and into 2018. Favorable factors include accelerating global GDP, accommodative central banks, manageable inflation, and robust corporate profits. Equities have responded well to this backdrop and if these trends continue, next year should provide similar results. A retrospect of 2017 features resilient stock markets marching higher despite heightened geopolitical tensions, devastating natural disasters, and a lack of US fiscal stimulus. Strong economic fundamentals help to explain this advance despite headline-grabbing obstacles. While our outlook is positive for equities, bond yields and money market yields should remain low but modestly increase throughout the next 6-12 months.

The US economy has improved throughout the year. We expect GDP to rise 2.3% in 2017 and accelerate further to 2.6% in 2018. On the positive side, the labor market is healthy, manufacturing is modestly expanding, inflation is low and stable, wages are gradually rising, and consumer confidence is sustaining elevated levels. Conversely, longer-term structural challenges, including aging baby boomers, elevated levels of student debt, income inequality, and the opioid crisis, continue to inhibit stronger growth. It should be noted that this year’s expansion has occurred with the Federal Reserve raising short term interest rates and without significant fiscal stimulus. Tax reform, deregulation, and infrastructure investments are among the policies that would help to boost production but are not necessary to attain another year of economic improvement.

Throughout this year, the Marietta Investment team has reiterated that US stocks are fully valued and require a rise in corporate profits to justify a further advance. Auspiciously, S&P 500 company earnings surged by 14% in the first quarter, 10% in the second quarter, and are expected to expand a similar amount in the year’s second half (source: FactSet). We continue to think that the bull market will persist as long as corporate profits keep progressing. As investors shift their focus to next year, FactSet consensus projects a further 11.1% upswing in S&P 500 companies’ bottom lines and a 5.1% gain in revenues. This would validate another positive year for US equities, though there are reasons for caution. We are watching closely incoming data to verify our constructive view.

The first nine months of 2017 have been marked with consistent outperformance of international stocks, with the iShares MSCI Emerging Markets ETF (EEM) soaring 28% and the iShares MSCI EAFE ETF (EFA) for developed countries advancing 18%. We think there is still further upside opportunity in the next 9-12 months. Our positive outlook centers on economic growth in key countries, strength in emerging market corporate profits, stable or improving commodity prices, heightened prospects for the euro zone, low and stable inflation, and supportive central banks.

An accelerating global growth environment is one of the best possible investing scenarios for international equities. The International Monetary Fund and a consensus of economists forecast a continued acceleration next year, and we agree. Additionally, every year this century when GDP has significantly accelerated, international stocks outperform their US counterparts. The current backdrop has similar characteristics to the early stages of 2003-2007 when the EEM outperformed the EFA and the S&P 500 by over 200% and 300% respectively.

Emerging economies are projected to expand around 5% in 2018. China GDP should rise over 6%, supported by consumer spending, stabilized commodity prices, and fiscal stimulus. Prospects for India look even brighter as bank sector reforms, improvements in infrastructure, and investments in technology should drive long-term GDP growth of 7% or higher. Brazil will post a modest recovery but its upside may be limited by political scandals and lagging reforms. Headline inflation has generally been on the decline in emerging countries, allowing central banks to continue accommodative approaches to monetary policy. In addition to a positive macroeconomic environment, emerging market company earnings are thriving, increasing 19.8% in 2017 and projected to progress at double-digits again in 2018 (source: JP Morgan). Relative valuations remain attractive, with the average 2017 price-to-earnings ratio at 12.4 versus 19.2 for the S&P 500.

The outlook for developed markets has also turned more constructive. Economic fundamentals in the EU have improved: manufacturing PMIs have accelerated, unemployment has decreased to the lowest level since 2009, and consumer and business confidence has improved to multi-year highs. An exception to the story of European strength is the United Kingdom as it negotiates its exit from the EU. Recently, the UK’s 2nd quarter GDP was revised downward to its lowest level in four years while at the same time inflation has mushroomed above its target, putting the Bank of England in the predicament of having to raise interest rates at the expense of stronger growth. Political populism in Europe remains a concern worth monitoring, but thus far has not dampened economic activity in the region as a whole. The political situation in Japan is likely to be stable even as snap elections will be held this month. GDP expanded for the 6th straight quarter, the longest run of expansion since 2006. Though structural demographic challenges linger, the world’s 3rd largest economy is not a drag on growth.

Oil prices have stabilized, but the medium and longer-term issues that caused the 50% drop since 2014 endure. Energy producers have become incredibly efficient at extracting oil such that US drillers have become the world’s swing producers rather than OPEC. Moreover, oil demand has plateaued amidst a global focus on renewable energy. We project oil prices to stay in the $45-60 range for the medium term, which is good for consumers but will drag on oil company margins. Commodities ex-oil should be stable because of accelerating GDP growth and a range-bound US dollar.

At current levels, bonds and money markets provide uncompetitive returns compared to equities. There are secular trends keeping global bond yields low for longer. With this in mind, we recommend that investors pay attention to the benchmark US 10-year Treasury note, currently yielding about 2.3%. If its yield rises closer to 3%, investors should consider adding exposure to bonds.

As with any positive view, there are always notes of caution. A hawkish change at the Federal Reserve, the advent of protectionist policies, and rising inflation are among the scenarios that could disrupt stock markets and potentially cause a correction. Year-to-date the US dollar has weakened -8.9% against several major currencies including the euro, pound and yen. We think the dollar will be range-bound or gradually weaken after several years of strength, but an extended rally could result in a rotation that would be problematic for international investors, commodity producers, and US multinationals. We are carefully tracking any risks that would challenge our forecast.

Economic And Financial Market Outlook 2017 Q3

At the beginning of 2017, the Marietta Investment Team forecasted that the first significant acceleration in global growth since 2010 would fuel a surge in corporate earnings and lead to stock market advances. Economic data of the past six months indicate that the global economy is indeed accelerating and we continue to expect global GDP growth of 3.2% this year and 3.6% next year. Driving this growth will be the international economies led by the emerging countries. On a cautionary note, we are modestly reducing our projection for U.S. GDP this year from 2.5% to 2.3%, which matches a similar reduction on June 27 by the International Monetary Fund. Stock markets have responded positively to the pickup in economic activity with the MSCI All-Country World ex-U.S. Index rising 14.1% and the S&P 500 rising 9.3% through the end of the 2nd quarter. We anticipate a further expansion in global profits and stock prices in the second half of 2017 and into 2018. Despite our reduced U.S. GDP forecast, we expect double-digit U.S. profit growth for all of 2017, which should permit at least a mid-teens S&P 500 return for the year.

The U.S. continues to exhibit steady but underwhelming growth. The labor market is strong in some aspects and lags in others. The unemployment rate has steadily decreased throughout the year and now stands at 4.3%, the lowest level since 2001. On the other hand, the labor participation rate remains stubbornly low and the last three months of jobs creation data from the Bureau of Labor Statistics have been below the 2016 average. Wage growth has been running between 2-3%, which is above inflation but is not robust. The financial health of consumers, which has been boosted by the jump in stock prices and a rise in home prices above 5%, has contributed to a near record high in consumer confidence. Household net worth reported a year-over-year gain of 8.3%, a 3-year high. U.S. consumer credit ratings have also reached a multi-year high, yet consumer spending has been modest. A convincing explanation for this restraint is elusive, but possibly a shift in consumer spending habits is underway. A similar development exists in the business world: CEO and small business confidence are at very high levels and profits are very strong, but businesses have been slow to invest. In sum, the U.S. is a steady contributor to the global economy, but the much-anticipated growth spurt has not occurred.

Marietta’s Investment Team is convinced that the key to the U.S. stock market is healthy corporate profit growth. We retain the view that the market’s P/E, which has risen steadily for several years, is close to fully valued. We consequently attribute the S&P 500’s six-month advance of 9.3% to the rise of over 15% in first quarter S&P 500 profits, the largest increase since the 4th quarter of 2011. To be sure, the corporate profit surge exceeded the increase in S&P stock prices, which actually improves the market’s valuation. Many research analysts currently expect a double-digit profit gain for the year, which they anticipate will extend into 2018.

We thus do not accept the view of some commentators that pro-growth legislation in Washington D.C. is necessary to provide a further advance in the U.S. market, but if this were to occur it may bolster the market rally. Important additional supports for the U.S. market are low inflation, low interest rates, and an accommodative Federal Reserve. Money market funds and bonds remain relatively unattractive competitors to the equity market. We also expect the combination of stock buybacks and dividend increases to continue at near record levels.

Back in early January we wrote, “[t]he 2017 outlook for international stock markets is more favorable than at any time since 2010.” Our view was that most investors were not anticipating an acceleration in global GDP growth. The economic pickup became increasingly evident as early as March, when The Economist titled its cover article (March 18-25), “On the Up: The World Economy’s Surprising Rise.” A month later, the IMF issued its updated World Economic Outlook, which supported our forecast:

Global economic activity is picking up with a long-awaited cyclical recovery in investment, manufacturing, and trade… stronger activity, expectations of more robust global demand, reduced deflationary pressures, and optimistic financial markets are all upside developments.

The positive response of international equity markets has been significant. Year-to-date through June 30, the iShares MSCI Emerging Markets ETF (EEM) rocketed 18.8% and the iShares MSCI EAFE ETF (EFA) for developed markets advanced 14.8%. We think there is more to come.

We reiterate our forecast for emerging market economies to grow 4.6% this year, led by India at 7% and China at 6.6%. China is making progress on its plan to shift economic growth from exports and investment to consumer spending. Retail sales consistently grew over 10% this year. Some commentators have expressed concerns regarding China’s debt situation, which we think needs to be monitored but a crisis is not imminent. We continue to recommend select Chinese consumer and technology stocks. We also find attractive investment opportunities elsewhere in Asia. Brazil’s stock market has suffered this year as the emergence from recession has been disappointing and political turmoil has buffeted the equity market. Other Latin American markets have performed well and we think there are opportunities with significant potential in this region.

In the developed world, investor attention is increasingly focused on the Euro Area. Here, the economy has improved significantly over the past six months and we now forecast an increase of 2% GDP growth in 2017. Recent data have surprised to the upside: Germany’s monthly Business Climate Index was the highest on record in June, consumer confidence in France soared to a 10-year high, and PMIs throughout the Eurozone have strengthened. Adding to the positive appeal of Euro Area equities has been the willingness of the European Central Bank to remain accommodative as the economy improves. With these tailwinds, the FTSE Euro 100 rose 15.1% thus far in 2017 in U.S. dollar terms. We are monitoring closely Japan, where consensus GDP growth estimates have been revised upward for 2017 from 0.6% to 1.2% (source: FactSet) and the Bank of Japan maintains its pro-growth policy.

The major threats to our positive stock market outlook would be a surprising deterioration in the Chinese economy, a further decline in commodity prices, a resurgent strength in the U.S. dollar, and the specter of protectionism and trade wars. We are watching key global political developments carefully, but do not expect any major surprises to disrupt economic growth.

Alternatives to equity investments are for the most part unfavorable. The bond market is unattractive: bond yields should rise as unprecedented central bank accommodation unwinds and economic growth picks up. The search for yield remains elusive, but lower-quality bonds are relatively attractive to more aggressive investors as long as economic growth persists. Commodities have had a mediocre first half of 2017, with oil plunging over 20% and most precious and base metals trailing the return of the S&P 500 Index. We think that global growth will provide stability to commodity prices but a significant increase in demand will require fiscal stimulus. In the meantime, supply issues could linger and cap substantial upside appreciation.

International Monetary Fund Supports Marietta Global Economic Outlook

Our April Outlook reiterated our positive January forecast that the world’s stock markets would rise in 2017 in response to a significant acceleration in global GDP growth for the first time since 2010. Yesterday, the IMF issued its updated World Economic Outlook, which supported our forecast:

“Global economic activity is picking up with a long-awaited cyclical recovery in investment, manufacturing, and trade… stronger activity, expectations of more robust global demand, reduced deflationary pressures, and optimistic financial markets are all upside developments.”

Especially important in the IMF’s optimistic outlook is that the acceleration will be compelling, broad-based, and sustainable: world growth is expected to rise from 3.1% in 2016 to 3.5% in 2017 and 3.6% in 2018. The growth spurt will also be synchronized with both advanced and emerging economies participating. US growth, for example, is projected by the IMF to rise from 1.6% in 2016 to 2.3% in 2017 and 2.5% in 2018.

We estimate that this higher growth in 2017 will result in double-digit profit gains for both US and international companies, which in turn will provide the fuel for further stock market gains.

As with all optimistic forecasts, there are risks to the downside. Here the IMF highlights, “a shift toward inward-looking policy platforms and protectionism,” increased geopolitical tensions, and a surprise slowdown in China.

Economic And Financial Market Outlook 2017 Q2

Recent indications of an improving global economy confirm our year-end view that global GDP growth will accelerate significantly in 2017 for the first time since 2010. This growth spurt originated with the bottom in commodity prices in early 2016 and is independent of, but would be further strengthened by, stimulative fiscal initiatives in the United States. Deflation and recession fears have evaporated and financial markets have shifted from expectations of slow growth, low inflation, and low interest rates to predictions of higher growth, higher inflation, and rising interest rates. Almost all the world’s stock markets responded positively to this improved outlook and we expect further advances as the expansion gathers steam. The major threat to the global economic expansion is the specter of protectionism and trade wars.

In a cover story with the headline “On the Up: The World Economy’s Surprising Rise” The Economist (March 18-24, 2017) echoes our forecast: “In America, Europe, Asia, and the Emerging Markets, for the first time since the brief rebound in 2010, all the burners are firing at once.” The lead article highlights progress in the U.S. and across the world’s economies. In Europe, the European Commission’s economic sentiment index reached its highest level since 2011 and Eurozone unemployment is at its lowest since 2009. In Japan, capital expenditure in the 4th quarter rose at its fastest rate in 3 years. The Institute of International Finance reported in January that the developing world hit its fastest monthly rate of growth since 2011. China has clearly stabilized its economy at over 6% GDP growth and has indicated that it will achieve its growth target without additional stimulus. The article also notes that in February, South Korea reported export growth above 20% and Taiwanese manufacturers have posted 12 consecutive months of expansion. In addition, the Brazilian and Russian economies are emerging from several years of recession. Our GDP forecast for emerging economies as a group remains a rise from 4.2% last year to 4.6% this year.

Expectations for the U.S. economy also have risen during the first quarter. Consumer confidence soared to 16 year highs, the Conference Board’s measure of CEO confidence surged, and the NFIB Small Business Optimism Index sustained a level above 105 for 3 consecutive months for the first time in over a decade. While we consider a swell in optimism as a healthy signal, a vibrant economic reality must follow to justify a further stock market advance. The rise in the U.S. stock market would seem to indicate that investors expect the improved sentiment will translate into higher growth in the near future. Recent data support this conclusion. So far this year the ISM manufacturing PMI reached a 28-month high, the ISM non-manufacturing PMI achieved a 16-month high, and year-over-year core retail sales growth of 6% attained a 5-year high, all while the unemployment rate remained at cyclical lows. Though this data paints a rosy picture, there is still room for considerable improvement in the form of increased wages, productivity, and capacity utilization. The U.S. is by no means at peak production, but the evidence of a bona fide economic acceleration is considerable. We reiterate our 2017 U.S. GDP projection of 2.5%, with a possible upward adjustment if fiscal stimulus materializes.

The U.S. stock market continued its advance in the first quarter, with the S&P 500 advancing 6.1%, though March marked a pullback from all-time highs. We consider the recent stock market weakness a temporary phenomenon in a typical bull market and believe a further advance is likely. Our economic growth projections should translate into corporate profit gains for the year of 10-12%, which should diminish valuation concerns. Positive tax reform and deregulation could provide an additional boost. While political headlines may cause temporary stock market volatility, the financial market fundamentals are as positive as they have been since 2010. In addition to an improving economy and a thriving labor market, inflation and interest rates have risen modestly but remain low. The Federal Reserve should still be considered accommodative and the potential interest rate hikes are not expected to threaten economic growth. Dividend increases, share buybacks, and cash reserves support the stock market. Further, bond yields remain low and do not pose a competitive alternative to stocks in a period of high confidence and rising growth.

At the beginning of the year, we forecasted in our Outlook that “the 2017 outlook for international stock markets is more favorable than at any time since 2010” and predicted further that “prospects are propitious for double-digit advances in many international stock markets.” Both the iShares ETF for developed international countries (EFA) and the iShares ETF for emerging markets (EEM) are off to a strong start in the first quarter and we expect further gains by the end of the year. The salient positive conditions include:

- Synchronized accelerating global economic growth, which has had a strong correlation with significant international equity market advances.

- Valuations of international equities are relatively attractive: P/E ratios of the EFA and the EEM are currently trading at discounts of 13% and 36% respectively to the S&P 500 Index. After years of underperformance, the EFA and the EEM are still approximately 30% below their 2007 highs, whereas the S&P 500 Index is 50% above its 2007 peak (Source: Factset).

- The perceived health of the Chinese economy, critical to global stability, has improved substantially over the past year. Most forecasts point to another year of at least 6% GDP growth. An important consequence has been a sharp increase in commodity prices since last February, which has improved many emerging market economies and their currencies. A considerable pick-up in 2017 global GDP growth should strengthen commodity prices and lift many emerging market stocks.

- A surge in the U.S. dollar from last August into December was very damaging to emerging market stocks. In contrast, the dollar has declined modestly in 2017, thereby supporting a rise in emerging stock markets. We project that the U.S. dollar will remain range-bound for the remainder of 2017.

- The cloud of Brexit hovering over the Euro Area and British economies should begin to lift now that the actual process of negotiation has commenced. Another support for European stocks is the slowing of populist political momentum.

- We expect that an acceleration in global economic growth this year will likely be accompanied by a modest pick-up in inflation. A rise in inflation in many countries will surely catch the attention of the world’s central banks, but we do not expect them to respond with rate hikes that would threaten growth.

Our positive outlook for the U.S. and international equity markets assumes that a host of risks are avoided. These include protectionism and trade wars, destabilizing political events, an inflation scare in the U.S. causing the Federal Reserve to move rates higher more quickly, a deterioration in the Chinese economy, another collapse in commodity prices, and the recent data being just a temporary “strong patch” rather than an acceleration. We do not foresee these circumstances arising in 2017. We remain focused on the incoming data and will offer updates if our outlook changes.

The U.S. bond market landscape has changed little since the beginning of the year. While bond yields have been range bound thus far, rising inflation expectations, stronger global growth, and probable Federal Reserve rate hikes are catalysts to rising bond yields. We continue to expect the benchmark 10-year Treasury Note to move gradually towards 3% by year end. We suggest underweighting the asset class and favor shorter maturities.

Economic And Financial Market Outlook 2017 Q1

Our positive 2017 outlook for most of the world’s stock markets is based primarily on our expectation of acceleration in global GDP growth from about 2.8% in 2016 to 3.2% next year. The catalyst will be the expectation of a return to growth brought about by stimulus initiatives from key governments and accommodative policies of the world’s major central banks. This will mark the first significant pickup in global growth since 2010, and should diminish the deflationary fears that have been dominant during the past several years. Financial markets have already started adjusting from low global growth, inflation, and interest rates to higher growth and reflation. We expect this trend to continue, but we are aware of potential risks which could alter the positive case significantly.

We expect the S&P 500 Index will mount a 10-12% advance in 2017, which will reflect a U.S. GDP rise from an estimated 1.6% in 2016 to 2.5% in 2017 and a low double-digit spurt in corporate profits. The incoming administration has promised voters it will produce job gains and a boost to growth arising from tax cuts, increased infrastructure and defense spending, and deregulation. The recent jump in consumer and small business confidence and the rally in stock prices to near record highs are signs of elevated expectations. We consider the S&P 500 Index to be fully valued. Thus stock prices will likely rise in line with the increase in corporate earnings.

Conditions could develop where our expectations could be either too optimistic or too pessimistic. The upside to our estimates includes the prospect of “multiple expansion” (an increase in the market’s P/E multiple resulting from stock prices rising more than earnings). Further support of stock prices could come from continued rotation out of bonds and into stocks. Bonds have received large inflows in recent years while equities have experienced consistent outflows. The Investment Company Institute has reported a shift in early December, and this trend may continue if investor confidence in equities remains high and bond prices continue to decline. The most likely and most serious risk to the U.S. market is consternation arising from a highly valued market combining with one or more of the following issues: fiscal stimulus doesn’t meet lofty expectations, inflation runs too hot, trade wars weigh on real GDP growth, and/or the strong dollar negatively impacts U.S. corporate profits.

Heading into a new year, where should investors focus? 2016 witnessed a seismic shift in the relative performance of industry sectors and investment styles, and we expect this trend to extend into 2017. In 2015, when earnings growth was scarce and the threat of recession and bear market was omnipresent, investors favored growth stocks in the consumer discretion, information technology, and health care sectors, whereas the cyclical, economy-sensitive energy, materials, industrial, and financial stocks were out of favor and suffered negative returns. 2016 turned 2015 upside down. Energy stocks surged with the reversal in oil prices, financial stocks soared as inflation and interest rates jumped, and industrials and materials stocks rose in expectation of improving economic conditions. At the bottom of the ladder were growth-heavy consumer and health care stocks. The changed fortunes of the Russell 1000 Growth and Russell 1000 Value Indexes reveal a similar pattern: the Growth Index led by 10 percentage points in 2015, but trailed by 9 percentage points in 2016. These trends indicate anticipation of successful economic changes to come. If the administration’s economic agenda underwhelms or is ineffective and the economy reverts to its prior slow growth, low inflation/low interest rate condition, the trend could reverse once again with serious consequences for unprepared investors.

| S&P 500 Index Industry Sector Performance | ||

| 2015 (%) | 2016 (%) | |

| Consumer Discretion | 8.4 | 4.3 |

| Consumer Staples | 3.8 | 2.6 |

| Energy | -23.6 | 23.7 |

| Financials | -3.5 | 20.1 |

| Health Care | 5.1 | -4.4 |

| Industrials | -4.7 | 16.1 |

| Information Technology | 4.3 | 12.0 |

| Materials | -10.4 | 14.1 |

| Telecommunications | -1.7 | 17.8 |

| Utilities | -8.4 | 12.2 |

| S&P 500 Index | -0.7 | 9.5 |

| Russell 1000 Growth Index | 4.0 | 5.3 |

| Russell 1000 Value Index | -6.2 | 14.3 |

| Source: FactSet |

International economic growth in 2017 is expected to be broad based. Our outlook, in line with the IMF, is that emerging economies will lead the way with GDP growth increasing from 4.2% this year to 4.6% next year. India will again set the pace with a gain of 7.0-7.5%. Most importantly, we think Chinese policy makers will continue to steer its growth dependence away from exports and investments and towards consumer spending without major dislocation. If China’s GDP continues to expand above 6%, as we anticipate, then global commodity prices, the lifeblood of many emerging countries, will likely continue to rise. In particular, we expect Brazil and Russia will emerge from recession in 2017. Economic gains in the developed countries will be more modest. The Euro Area and the U.K. will need to navigate Brexit and hurdle some contentious elections, while Japan will continue its battle against deflation and economic stagnation. These economies will depend on weakened currencies for strength in exports in order to achieve 1.0-2.0% growth. Better prospects exist for Canada (+2.0%), which will be impacted favorably by U.S. growth, and Australia (+3.0%), which will be helped by rising commodity prices.

The 2017 outlook for international stock markets is more favorable than at any time since 2010. Commodity prices (measured by the CRB Index, representing a basket of commodities) have risen in 7 years and declined in 7 years since 2002: the iShares ETF for emerging markets (EEM) has risen in every up year and outperformed the S&P 500 Index in each of these years with one exception. Another positive is that valuations for international markets, and especially emerging country markets, are very attractive following years of underperformance. Our conclusion is that prospects are propitious for double-digit advances in many international stock markets. We share our optimism with the J. P. Morgan Research Team, who foresees a 2017 surge of 16.2% in emerging markets and advances of 10.1% in Euro Area and Japanese stocks.

U.S. bond markets will need to contend with rising inflation and additional rate hikes from the Federal Reserve. The huge surge in bond yields since the summer of 2016, which included a rise from 1.36% to 2.45% in the yield on the benchmark 10-year U.S. Treasury note, has already damaged fixed-income portfolios with long maturities. Heading into 2017, the labor market has already tightened to near or full employment, and the new administration’s agenda is clearly inflationary. Our forecast is a further rise in inflation from an estimated 1.5% this year to 2.5% or higher in 2017. We expect this will push the 10-year Treasury yield above 3.0% by year end 2017 with a spike over 3.5% at some point during the year.

There are risks to any forecast, and some market observers insist that the uncertainties now are so great that predictions are worthless. We agree that uncertainties are greater than in the past, but a well-researched outlook will serve investors well. We have confidence in our outlook, but we acknowledge the need to be vigilant and flexible.